Welcome to Think360

Transforming your data into intelligent insights and

Build Hyper-Responsive Businesses

Make Data-Driven Decision a Reality

Optimize Operations and Expedite Growth

All at the intersection of data, analytics, and human intelligence

Every single day an enormous amount of data is generated by businesses globally, and unfortunately, only a fraction (less than 5%) is used for discovering next-level intelligence. Our powerful analytical models allow process owners like you to fine-tune your decisioning and make your own data speak to you.

We provide enterprises with access to analytical tools, frameworks, and resources and create micro-services to integrate, conceptualize, analyze, customize, and visualize data to unlock new potential. Leveraging various data science services and advanced analytics solutions, you can make informed decisions at lightning speed and with utmost precision. With Think360.AI, you are never far away from your next big idea.

Pharma and Life Sciences Analytics

Accelerate growth with our advanced solutions—Data Analytics as A Platform, Analytics as A Service, and AI & ML Capabilities. Our team is built with the right mix of tested industry experts with real world experience, and data analytics gurus to make your analytics journey easy and deliver impact across key focus areas:

- Commercial

- Market Access

- HUB & Patient Services

Shipping and Supply Chain Analytics

Analyze multi-variate data points to understand how to control risks and opportunities, and how it affects your shipping-maritime business.

Explore Topics Like:

- Maritime & Shipping Operations

- Route Optimization

- Predictive maintenance

- ESG Analytics and more

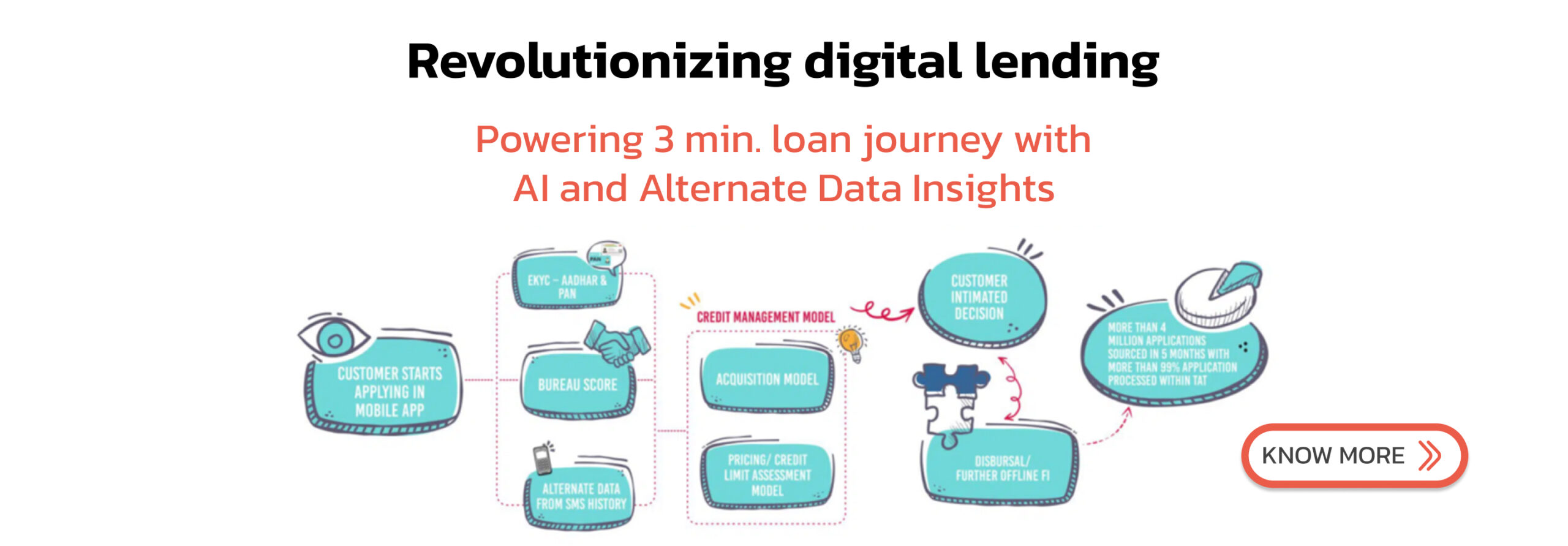

Analytics for BFSI

- Risk management

- Fraud detection

- Process analytics

- Customer and investment analytics

- Compliance management

Retail Analytics

- Manufacturing and inventory management

- Demand and supply chain analytics

- Sales & marketing intelligence

- Consumer behaviour and customer analytics

- Sourcing and procurement and more