The world is changing at an unprecedented pace, and as we strive to create a future with sustainable finance, the industry itself has a critical role to play. But do sustainability and finance go hand in hand? To help address the complex challenges facing our planet, many financial institutions are turning to artificial intelligence (AI) to enable more efficient and sustainable practices.

The use of AI in banking has grown rapidly in recent years, with banks and financial institutions leveraging this technology to improve customer experiences, reduce operational costs, and enhance risk management. This will eventually bring an introduction to sustainable finance here. According to a report by Accenture, the use of AI in the banking industry is expected to generate $140 billion in productivity gains by 2025.

By analyzing vast amounts of data and identifying patterns and trends, AI can help banks make more informed decisions and improve overall business performance. However, the implementation of AI in banking also raises important ethical and regulatory considerations, such as data privacy and security, transparency, and bias. As such, it is crucial for banks and financial institutions to approach the adoption of AI with caution, and accountability is required.

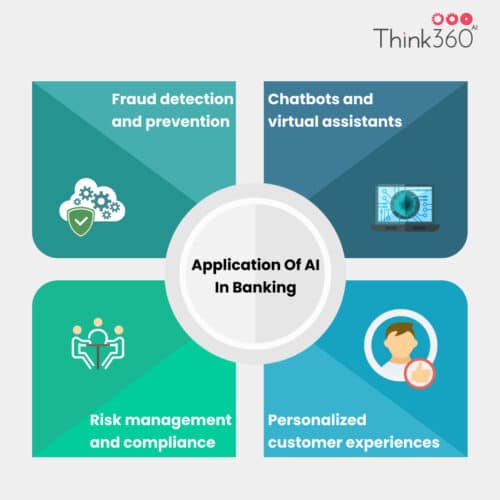

AI has numerous applications in banking, which includes:

There are reasons why you need to prioritize sustainable finance. But, what is it, what is sustainable finance and how can it impact the future of the finance industry, you need to figure out, what the term actual is!

What Is Sustainable Finance?

Sustainable finance refers to financial activities that integrate environmental, social, and governance (ESG) criteria into investment decisions and promote sustainable economic growth. Sustainable finance is concerned with achieving a balance between economic growth, social development, and environmental protection. Sustainable finance includes a range of financial activities such as green bonds, social bonds, sustainability-linked loans, and impact investing.

These financial instruments are designed to support sustainable finance activities and transition towards a low-carbon, resilient, and inclusive economy. Sustainable finance also involves the integration of ESG (environmental, social, and governance) factors into the investment process. This approach helps investors to identify and manage risks related to ESG factors, such as climate change, social inequality, and human rights violations.

Impact of AI On Sustainable Finance

Artificial intelligence (AI) has the potential to significantly impact the sustainable finance industry by improving data analysis, risk assessment, and decision-making processes.

1.Data Analysis with the help of NLP

The use of natural language processing (NLP) in sustainable finance is a rapidly growing area. NLP is a branch of AI that allows machines to understand human language and analyze unstructured data such as news articles, social media posts, and financial reports. By using NLP algorithms, companies can identify emerging ESG risks and assess the sustainability performance of potential investments.

According to a report by the Global Sustainable Investment Alliance, the use of AI and machine learning in sustainable investing is on the rise, with $6.2 trillion in assets under management globally utilizing these technologies.

Overall, the use of NLP and AI in sustainable finance is an increasingly important tool for investors and companies to assess ESG risks and opportunities. As the volume of ESG data continues to grow, the use of AI and NLP will become even more critical in helping investors make informed decisions that promote sustainable development.

2. Risk assessment for precautions

The use of AI in risk assessment is an important area within sustainable finance, as it can help investors better understand the potential risks associated with a particular investment. By analyzing large amounts of data, AI algorithms can identify patterns and make predictions that can assist in assessing the potential impact of climate change, supply chain disruptions, and other ESG factors.

According to a report by the McKinsey Global Institute, the use of AI in risk management is expected to create between $1.5 trillion and $2.6 trillion in annual economic value across multiple sectors, including finance. The report notes that AI can help financial institutions better manage risk by analyzing vast amounts of data and identifying patterns that humans may miss.

Overall, the use of AI in risk assessment is a rapidly growing area within sustainable finance. By analyzing vast amounts of data and identifying patterns and trends, AI algorithms can help investors better understand the potential risks associated with a particular investment, including those related to climate change, supply chain disruptions, and other ESG factors. This can ultimately help investors make more informed decisions that promote sustainable development.

3.Decision making process

AI can indeed provide insights into the sustainability performance of companies and investment portfolios, which can help investors make more informed decisions. By analyzing vast amounts of ESG data, AI algorithms can provide a sustainability score for a company, which can be used to compare it to other companies in the same industry.

Overall, the use of AI to provide sustainability scores is an important tool for investors in sustainable finance. By analyzing vast amounts of ESG data and providing a standardized score, AI can help investors compare the sustainability performance of different companies and make more informed decisions that promote sustainable development.

As AI lays multiple effects on financial sustainability, it also comes up with opportunities and challenges. You can see them in the next section here!

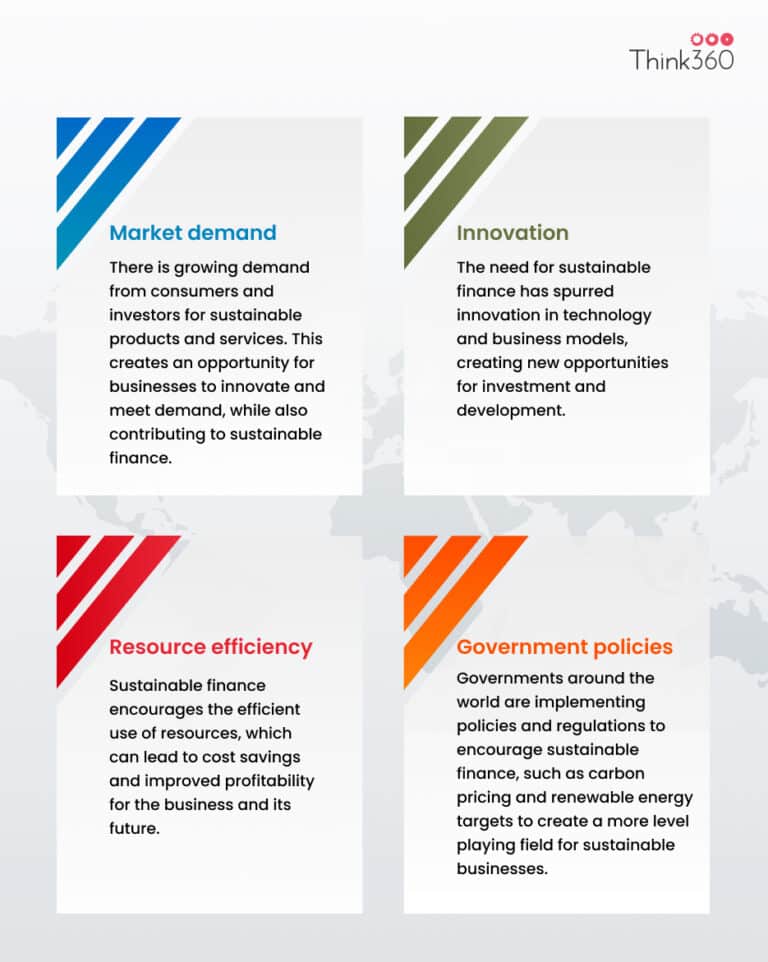

Opportunities and challenges for sustainable development and finance

Finance and sustainability are two fields that are becoming increasingly interconnected in our world today. Finance, which deals with the management of money and investments, has a significant impact on the environment and society, both positively and negatively. Sustainability, on the other hand, focuses on meeting the needs of the present without compromising the ability of future generations to meet their own needs.

In recent years, there has been growing recognition of the importance of sustainable finance. Investors, governments, and businesses are increasingly prioritizing investments that promote sustainable development. This trend is driven by concerns over climate change, resource depletion, and social inequality, as well as the potential sustainable financial benefits for investments.

What are the key areas where Finance and Sustainability go together?

The integration of finance and sustainability is a complex and multi-faceted topic, encompassing a range of strategies and approaches. Some of the key areas where finance and sustainability intersect include sustainable investing, green bonds, carbon trading, sustainable finance standards, and corporate social responsibility. By integrating sustainability into finance, we can help create a more equitable and sustainable future for all. Here are some key areas to keep into account!

Risk management

One of the key areas where AI is being used in sustainable finance is risk management. Financial institutions are using AI algorithms to analyze vast amounts of data from various sources, including market trends, company performance data, and economic indicators, to identify potential risks. This can help institutions to make more informed decisions and mitigate potential risks, such as fraudulent activities and market fluctuations.

Investment management

Another area where AI is making a significant impact is investment management. AI algorithms can analyze market trends, company performance data, and other economic indicators to identify investment opportunities that align with sustainable and ethical principles. This can help investors to make more informed decisions that are aligned with their values.

Carbon footprint analysis

AI is also being used to help companies track their carbon footprint by analyzing data from various sources, including energy consumption, supply chain, and transportation. By analyzing this data, companies can identify areas where they can reduce their carbon footprint and develop more sustainable practices.

Climate risk analysis

Finally, AI can help financial institutions to assess climate-related risks, such as the impact of extreme weather events on their investments. This can help institutions to make more informed decisions and develop strategies to mitigate these risks.

Conclusion

In conclusion, the intersection of AI and sustainable finance presents significant opportunities for financial institutions to promote sustainable economic growth while managing risks associated with environmental, social, and governance factors.

AI can help investors and companies make more informed decisions, improve risk assessment, and promote sustainable development by analyzing vast amounts of data and identifying patterns and trends that humans may miss. However, the adoption of AI in sustainable finance also raises important ethical and regulatory considerations, such as data privacy and security, transparency, and bias. Therefore, it is crucial for financial institutions to approach the adoption of AI with caution and accountability while prioritizing sustainable finance. Overall, the integration of AI in sustainable finance has the potential to drive significant positive impacts and reshape the future of the finance industry.