Banks and Non-Banking Financial Companies (NBFCs) in India have been engaged in discussions about seeking an extension for the roll-out of the Indian Accounting Standard (Ind-AS). Originally scheduled to be implemented from April 1, 2018, the new standard, known as “Expected Credit Loss” (ECL), has now been rescheduled for April 1, 2019, for banks.

The financial institutions are requesting an extension due to several reasons, including higher capital requirements for bad loan provisioning and delays in completing rules by the Reserve Bank of India. As institutions explore multiple approaches and assess the impact on their portfolios, let’s delve deeper into what ECL is and how it can potentially help address the rising Non-Performing Asset (NPA) challenges.

Why was ECL introduced?

The roots of the ECL method can be traced back to the global fiscal crisis of 2007-2008. In the aftermath of the crisis, it became clear to stakeholders in the Banking and Finance industry worldwide that existing loan loss provisioning norms and practices needed a complete overhaul.

To address the systemic costs of delayed recognition of credit losses under the “incurred loss” based approach, the International Accounting Standards Board (IASB) introduced the proactive standard on “Expected Credit Loss” (ECL) for loan loss provisioning under IFRS 9 in 2014. This standard was expected to be adopted by major economies, including India, between 2018 and 2021.

What is expected credit loss?

In simple terms, ECL represents the present value of all cash shortfalls over the expected life of a financial instrument. A cash shortfall refers to the difference between the contractual cash flows that are due to an entity and the cash flows that the entity expects to receive. To measure ECL, the following factors are considered:

- Probability-weighted amount of potential losses with no biases.

- The time-value of money.

- Reasonable and supportable information about past events, current conditions, and forecasts of future economic conditions.

How is ECL Calculated?

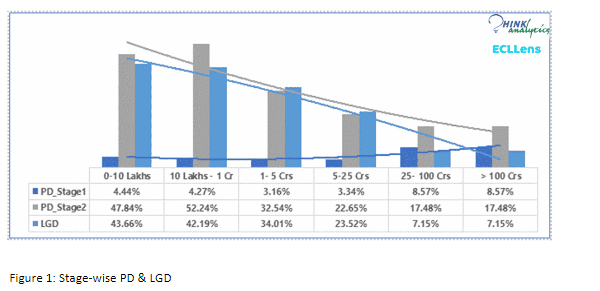

The calculation of expected credit loss formula for any financial instrument involves three crucial parameters: Probability of Default (PD), Loss Given Default (LGD), and Exposure at Default (EAD). The product of these three parameters results in the ECL value:

ECL = PD * LGD * EAD

For greater precision in ECL calculations, the reporting is done in three stages, corresponding to the deterioration in the credit quality of the financial instrument:

- Stage 1 (Performing Asset): This stage begins as soon as the financial instrument is started. Lenders calculate a 12-month ECL as the portion of lifetime ECL that may result from default events on the financial instrument within 12 months after the reporting date.

- Stage 2 (Under-performing Asset): When the credit quality starts deteriorating and the credit risk increases, the instrument moves into Stage 2. Here, a lifetime ECL is calculated, standing for the number of expected losses during the remaining contractual life of the instrument.

- Stage 3 (Non-Performing Asset): Finally, when the instrument becomes credit impaired, it moves into Stage 3. Like Stage 2, a lifetime ECL is calculated to represent the expected losses during the remaining contractual life.

Can ECL be the panacea for rising NPA?

The introduction of the ECL methodology seems to be a justified step towards containing the growth of non-performing assets. ECL empowers financial institutions to identify the movement of asset performance in different stages, estimate expected losses, and take timely corrective actions.

While this new method may have a somewhat negative impact on capital ratios in the short term, it holds the potential to weed out the growth of non-performing assets from the books in the long run. How to calculate expected credit loss for trade receivables, is one of the most tough questions to answer. While it’s too early to claim that ECL is the ultimate solution for mitigating NPA, it undoubtedly supplies the ingredients necessary to address the challenges of monitoring and controlling NPA effectively.

At Think360, we understand the significance of ECL compliance and its impact on NBFCs. To ease the transition, we have developed “ECLLens,” an AI-enabled ECL modelling solution. ECLLens offers a fast and efficient way for NBFCs to:

- Obtain Stage-wise ECL by vintage, geography, exposure, score band, etc.

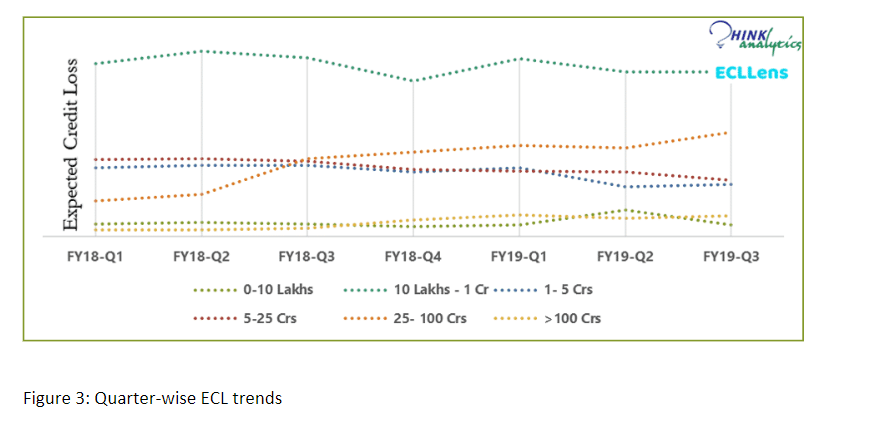

- Visualize quarter-wise trends of ECL, Probability of Default (PD), and Loss Given Default (LGD).

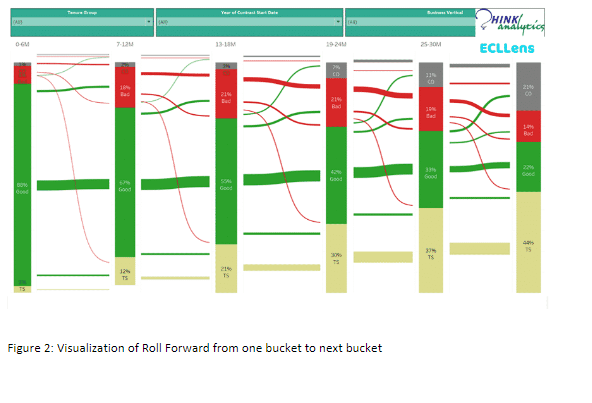

- Visualize the roll rate of contracts/borrowers from one bucket to the next over successive years during the contract’s lifetime.

- Easily download data into Excel for further analysis.

- Have login-based access to a web-interface for ongoing review and monitoring.

With ECL, we aim to assist NBFCs in navigating the complexities of ECL implementation while ensuring compliance and optimized risk management.

In Conclusion

The adoption of the Expected Credit Loss method holds great promise for the Indian financial sector. While it presents initial challenges, its potential benefits in managing NPAs and enhancing risk management are worth the effort. As banks and financial institutions embrace this new standard, we look forward to seeing its transformative impact on the industry’s financial health in the coming years.