AI-based credit scoring and the landscape of financial transactions are constantly seeking innovative solutions to streamline processes, reduce risks, and make informed decisions. One such transformative tool that has gained prominence in recent years is AI-based credit scoring. In the realm of Business-to-Business (B2B) interactions, this technology of credit scoring with Algo360 is proving to be a game-changer, revolutionizing the way creditworthiness is assessed and financial decisions are made.

The Evolution of Credit Scoring in B2B:

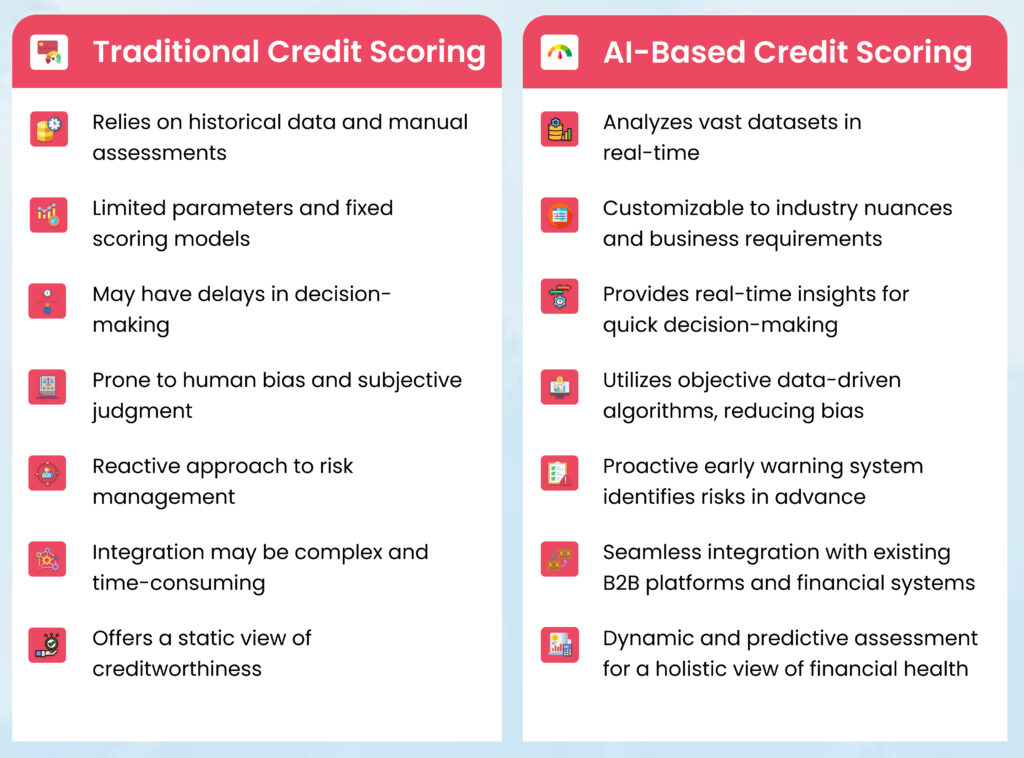

n the traditional B2B credit scoring landscape, businesses relied on manual assessments conducted by human underwriters. This approach involved a time-consuming review of financial documents and historical payment data. Credit scoring was based on a predetermined set of parameters, often resulting in a somewhat static evaluation. The reliance on historical data meant that the models were backward-looking and might not accurately capture a business’s real-time financial health.

AI systems, powered by machine learning algorithms, enable a dynamic, data-driven, and predictive assessment of creditworthiness. These systems analyze vast amounts of real-time data, offering an up-to-date and accurate representation of a business’s financial standing. Predictive modelling allows for anticipating future financial behaviours, reducing bias, and providing a more objective evaluation. Additionally, AI-based credit scoring brings flexibility and customization, aligning with specific industries and individual business requirements. The real-time insights provided by AI are crucial for swift decision-making in the fast-paced B2B environment.

Overall, the evolution to AI-based credit scoring enhances accuracy, speed, and adaptability. Check out the table below for better understanding.

Key Benefits of AI-Based Credit Scoring for B2B:

Improved Accuracy and Predictability

AI algorithms leverage vast amounts of data to analyze patterns and trends, offering a more accurate assessment of a company’s creditworthiness. This enhanced precision enables businesses to make well-informed decisions, minimizing the risk of defaults and late payments.

Real-Time Decision-Making

The speed of business is accelerating, and traditional credit scoring methods often struggle to keep pace. AI-based credit scoring provides real-time insights, allowing businesses to make quick decisions, seize opportunities, and navigate the fast-paced B2B landscape with agility.

Customization and Flexibility

Unlike rigid traditional scoring models, AI-based systems can be tailored to specific industry nuances and individual business requirements. This customization ensures that the credit scoring process aligns seamlessly with the unique characteristics of B2B transactions.

Early Warning System

AI algorithms can identify potential risks and red flags early on, serving as an effective early warning system for businesses. This proactive approach empowers organizations to take preventive measures and mitigate potential financial challenges before they escalate.

Integration with Existing Systems

AI-based credit scoring systems are designed to integrate seamlessly with existing B2B platforms and financial systems. This integration enhances workflow efficiency, reduces manual data entry, and provides a holistic view of a business’s financial health.

Challenges and Considerations

While AI-based credit scoring offers numerous advantages, it is crucial for businesses to be mindful of potential challenges. Ethical considerations, data privacy, and the need for ongoing algorithmic transparency are paramount to ensuring the responsible use of AI in B2B credit assessments.

Conclusion

In the dynamic world of B2B transactions, staying ahead requires leveraging cutting-edge technologies. AI-based credit scoring emerges as a powerful tool, offering unparalleled accuracy, real-time insights, and customization options to businesses. By embracing this transformative technology, B2B enterprises can navigate financial landscapes with confidence, making informed decisions that drive growth and foster lasting partnerships. As AI continues to evolve, its role in shaping the future of B2B credit assessments is set to become even more significant.

Schedule a call with our experts at Think360 and dive into the ease of credit scoring!