India has witnessed a transformative wave in the financial sector, with technology playing a pivotal role in reshaping traditional banking and lending practices. One of the key drivers of this revolution is the adoption of Application Programming Interfaces (APIs) in lending, offering a streamlined and efficient way for financial institutions to extend credit services. In this blog post, we will delve into the realm of Lending API Solutions in India, exploring their significance, key players, benefits, challenges, and impact on financial inclusion.

Understanding Lending API Solutions:

Lending APIs act as the bridge between financial institutions and various technology platforms, enabling seamless integration of lending services into third-party applications. According to a report by PwC India, the digital lending market in India is expected to grow at a compound annual growth rate (CAGR) of 36% between 2021 and 2026, underscoring the rapid adoption of technology-driven lending solutions. These Lending API Solutions In India facilitate the exchange of data and information between lenders and borrowers, automating the lending process and enhancing overall efficiency.

Key Players in the Indian Lending API Ecosystem:

Digital Lending Platforms:

Digital lending platforms have emerged as key players in the lending API ecosystem. These platforms leverage APIs to connect lenders with borrowers, providing a user-friendly and secure interface for loan transactions.

Banks and Financial Institutions:

Traditional banks and financial institutions are increasingly integrating APIs into their systems to offer a more agile and responsive lending process. They have embraced API technology to cater to the evolving needs of their customers.

Fintech Startups:

The Indian fintech landscape is teeming with startups that are leveraging lending APIs to introduce innovative and tailored credit solutions. These startups often focus on specific niches, such as buy-now-pay-later models or micro-lending services.

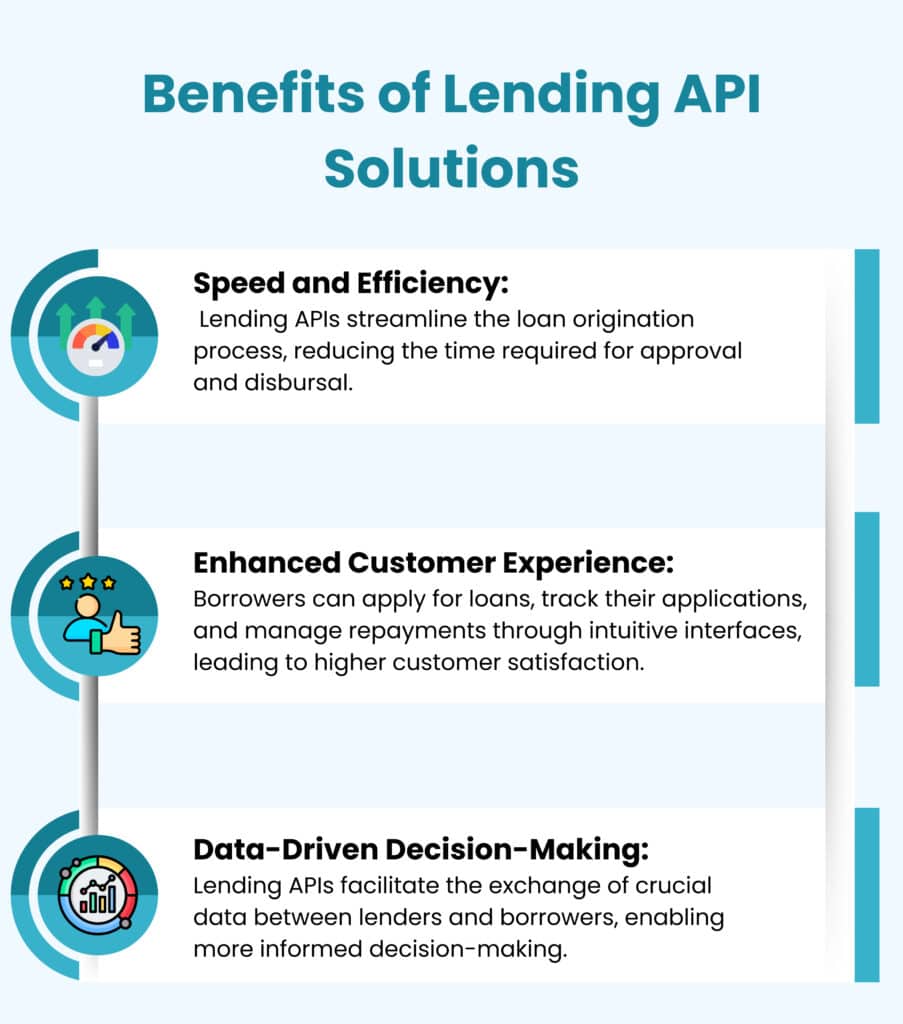

Benefits of Lending API Solutions

Fasten your seatbelts as we unravel how these APIs are not just streamlining processes but crafting an entirely new narrative for financial inclusion—one where urgency meets user-friendliness, and decisions are not just made but are data-driven masterpieces. Welcome to the era where lending is not just a transaction; it’s an orchestrated symphony of efficiency, experience, and insight. Welcome to the world of Lending API Solutions in India.

- Speed and Efficiency: Lending APIs play a crucial role in expediting the loan origination process, transforming what was traditionally a time-consuming journey into a streamlined and swift experience. When borrowers apply for loans through platforms integrated with lending APIs, the automation of various stages in the lending lifecycle significantly reduces the time required for approval and disbursal. In the conventional lending landscape, the approval process often involved manual paperwork, physical verification, and a lengthy underwriting process. Lending APIs automate these steps, allowing for real-time processing of applications. This rapid turnaround is particularly advantageous for borrowers with urgent financial needs, such as unexpected medical expenses or time-sensitive business opportunities. By leveraging technology, lenders can efficiently assess applications, determine eligibility, and disburse funds promptly, addressing the immediate financial requirements of borrowers.

- Enhanced Customer Experience: The integration of APIs into lending platforms goes beyond just expediting processes; it transforms the entire borrower experience. Through user-friendly interfaces, borrowers can seamlessly navigate the lending journey, from application to repayment. The convenience afforded by APIs enhances customer satisfaction by providing a more accessible and intuitive way to interact with lending institutions. Borrowers can initiate loan applications from the comfort of their homes, using digital devices such as smartphones or computers. The transparency and accessibility offered by lending APIs empower borrowers to track the status of their applications in real-time. Additionally, features like automated notifications and alerts keep borrowers informed about important milestones, ensuring they are actively engaged throughout the lending process. Managing repayments also becomes more convenient through intuitive interfaces. Borrowers can access information about their loan terms, outstanding balances, and repayment schedules effortlessly. This not only improves the overall experience but also contributes to a positive perception of the lending institution, fostering trust and long-term customer relationships.

- Data-Driven Decision Making: Lending APIs facilitate a seamless exchange of critical data between lenders and borrowers, revolutionizing the decision-making process. Through these APIs, lenders gain access to a wealth of information about applicants, ranging from credit history and financial behavior to employment details. This influx of data empowers lenders to make more informed and precise decisions regarding loan approvals, interest rates, and repayment terms.

The data-driven approach supported by lending APIs enhances risk assessment capabilities. Lenders can analyze a comprehensive set of variables, identify patterns, and assess the creditworthiness of applicants with greater accuracy. This not only minimizes the risk of defaults but also allows lenders to tailor loan offerings based on individual profiles. Furthermore, the data exchanged through lending APIs contributes to the continuous improvement of lending algorithms. Over time, as more data is processed, lenders can refine their risk models, ensuring that decision-making processes remain adaptive and responsive to evolving market conditions. Ultimately, the reliance on data-driven insights positions lending institutions to make more accurate loan pricing decisions, benefiting both lenders and borrowers in the long run.

The widespread adoption of lending APIs has significant implications for financial inclusion in India. By leveraging technology, lenders can reach underserved and unbanked populations, providing them access to formal credit channels. This, in turn, empowers individuals and small businesses, fostering economic growth and reducing dependency on informal lending sources.

Conclusion

In conclusion, the era of Lending API Solutions in India is not just a chapter; it’s a saga of financial evolution. As we embrace the power of technology with Think360 to reshape lending practices—it’s a harmonious blend of efficiency, experience, and insight, contributing to the inclusive growth of a nation on the cusp of a digital financial renaissance.

Book a call to transform your lending solutions today!