In the realm of investment management, understanding portfolio risk is paramount to making informed decisions that strike the delicate balance between risk and return. A portfolio, a collection of investments, carries inherent risk, and comprehending how to analyse and manage it is essential for financial success. In this blog, we delve into the intricacies of portfolio risk, its measurement, analysis, and management, equipping investors with the tools to navigate the dynamic landscape of financial markets.

Portfolio Risk: Defining the Landscape

A portfolio, often comprising stocks, bonds, and other assets, embodies a unique blend of risk and return potential. Portfolio risk refers to the uncertainty that investors face concerning the returns on their investments. As the saying goes, “Don’t put all your eggs in one basket,” diversification becomes the first line of defence against portfolio risk. By spreading investments across various asset classes and industries, investors can mitigate the impact of individual asset volatility on the overall portfolio.

Understanding Portfolio Risk and Return

In the realm of investment, risk and return are inseparable companions. Investors must assess both sides of the coin when constructing a portfolio. High-risk assets may offer the allure of substantial returns, but they also expose investors to greater uncertainty and potential losses. Conversely, low-risk assets tend to offer more stable returns but may yield lower growth potential. Balancing risk and return is the cornerstone of portfolio construction.

Portfolio Risk Formula: Unravelling the Equation

Quantifying portfolio risk is a mathematical endeavour that requires a comprehensive understanding of the relationship between assets. A commonly used metric is the standard deviation, which measures the dispersion of asset returns from the portfolio’s average return. The portfolio risk formula integrates asset weights and their respective variances to assess the overall riskiness of the portfolio.

Analysing Portfolio Risk: Embracing Statistical Tools

Portfolio risk analysis involves a profound exploration of historical performance, asset correlations, and various risk measures. Modern portfolio theory (MPT), developed by Harry Markowitz, is a fundamental approach to portfolio risk analysis. MPT emphasizes the importance of diversification and helps investors construct efficient portfolios that maximize returns for a given level of risk.

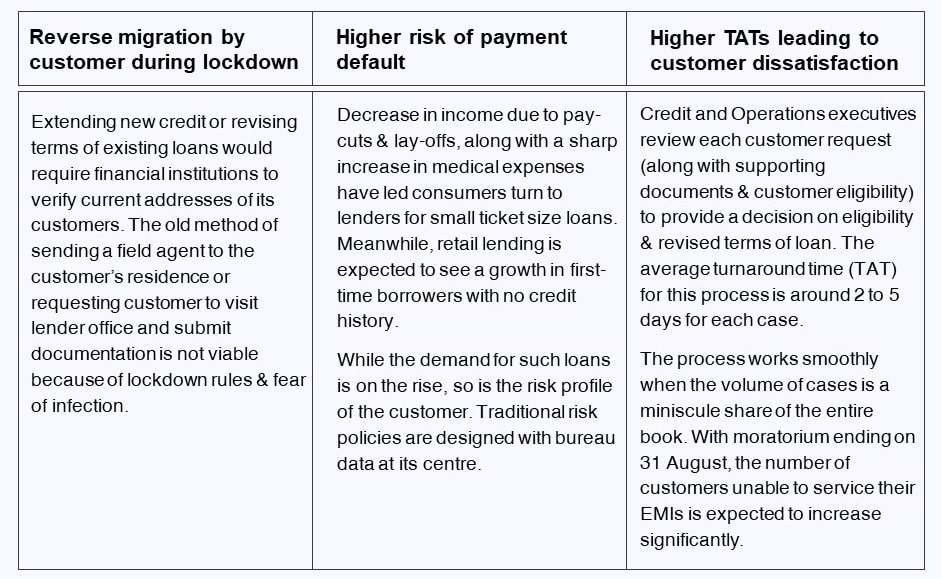

Challenges in the financial ecosystem affecting customers

Each customer is re-evaluated on their current capability to service a loan—however, six months of payment holiday unfavourably impact the intent to pay even when they have the ability.

The following table presents some of the recent challenges faced by customers:

What is loan restructuring?

When a borrower faces financial stress, they reach out to their lender to revise the terms of their credit facility by modifying one or a combination of tenure of loan/ interest payable on residual loan amount/ outstanding loan. This ensures that as a borrower, one does not miss out on payments towards their loan. Basel norms define debt restructuring as an indicator of asset quality going northwards and want banks to keep capital allocation for the eventuality.

While debt restructuring is an efficient tool to ensure that the bank recovers its principal, it has its own set of challenges. For example, since 2018 in India, there have been instances of a few stalwart banking leaders being asked to move on as debt evergreening was highlighted as favouritism.

Financial institutions can leverage data from the credit bureau as well as review customer behaviour and professional details to help customers plan their restructuring requests.

Loan restructuring in five easy steps

A collaboration with Think Analytics will ensure ease of operations, manage alternate data and manage government benefits. We combine analytics and web application development to service customer requests for restructuring and top-up. Our products and offerings will aid the loan-restructuring process to become hassle-free for both financial institutions and their customers. The proposed five-step process is:

Analysing behaviour score (B-Score):

Categorizing customers based on their past performance on loans. All customers who were more than 30 days due as of March 2020 would be categorized as red, along with other customers whose past repayment behaviour models those with high-risk default probability. The remainder would be evaluated for restructuring basis of their risk profile.

Identifying problems based on risk score:

Pre-approved customer list, eligible as per lender’s policy. Risk scorecard for approved customers along with updated offer details .

Restructuring the application:

Send an SMS to eligible customers with a link to open a web/mobile widget for the application. The link expires in 30 days. Auto-populate available customer details as per the lender’s database. Request for alternate data—current address, proof of current income

Offer optional integration with Kwik.ID to verify KYC details. Our video KYC product Kwik.ID currently helps our clients conduct 1500+ sessions daily. Kwik.ID is designed to ensure that video KYC is possible even with low bandwidth.

Offer optional integration with Algo360 for mobile app-based customers, to triangulate alternate data on income and net debt obligations.

Developing a business rule engine to approve restructuring:

Integrate with the business rule engine configured with risk and policy rules to determine revised terms of the loan. Share updated loan details and T&C with customers, e.g., SMS, email, and mobile app notifications.

Establishing an admin portal:

Manual review portal for the Credit and Operations team to review documents and approve/reject a request. This solution can be applied as a preventive risk mitigation policy where, every quarter, customers who show signs of financial stress can be assessed for debt restructuring, while the collections strategy incorporates the possibility of a customer seeking relief. The solution can also be used for providing top-up to customers who are on the other side of the curve, displaying financial stability.

Conclusion: Empowering Investment Decision-Making

Navigating the world of investments demands a clear understanding of portfolio risk and return dynamics. As investors seek to achieve their financial goals, recognizing and managing portfolio risk is essential. Employing statistical tools, risk analysis, and prudent risk management techniques can empower investors to make informed choices that strike the right balance between risk and reward. In the ever-evolving financial landscape, staying vigilant and proactive will ensure a path towards financial success.

The Reserve Bank of India (RBI) has provided a limited period window to restructure loans without downgrading the loan account to “non-standard” for (eligible) customers affected by the COVID-19 pandemic. On its own, debt restructuring is an excellent tool to allow customers to re-negotiate the terms and ensure that the bank recovers its principal. It is, however, important to have continued focus on credit and fraud risk and to use the tool effectively for risk mitigation. Talk to one of our experts and get to know more about the matter now!