In the vast sea of financial transactions, the role of loan underwriting and risk assessment is akin to a skilled navigator guiding a ship through unpredictable waters. Whether you are a financial institution, a borrower, or an intrigued onlooker, understanding the intricacies of this process is paramount.

Setting Sail: The Basics of Loan Underwriting

At its essence, loan underwriting is a meticulous process, akin to charting the course of a ship through uncharted financial waters. This process involves a comprehensive examination of a borrower’s financial profile, serving as the foundation for responsible lending practices. By thoroughly assessing a borrower’s financial health, lenders can make informed decisions, mitigating risks and fostering a relationship built on trust and transparency.

The Key Components Of Loan Underwriting And Risk Assessment Process!

Loan underwriting and risk assessment are integral components of responsible lending, ensuring a secure financial journey for both lenders and borrowers. Key components include:

1. Financial Health Examination

- Credit History: Just as a ship’s log tells its story, a borrower’s credit history narrates their financial journey. Lenders scrutinize credit reports to understand past behaviours, identifying patterns that may influence future financial voyages.

- Debt-to-income Ratio: Like calibrating a ship’s cargo for optimal balance, lenders analyse a borrower’s debt-to-income ratio. This key metric provides insights into the borrower’s capacity to manage additional financial obligations.

2. Risk Assessment

- Collateral Evaluation: Just as a ship’s worth is often determined by its cargo, collateral serves as security for loans. Lenders assess the value and condition of collateral, determining its potential to cover the loan in case of unforeseen challenges.

- Market Conditions: Sailing through economic tides requires an understanding of market conditions. Lenders factor in economic trends, interest rates, and industry outlooks to gauge external factors that may impact a borrower’s ability to repay.

3. Regulatory Compliance

- Navigating Legal Waters: Loan underwriting involves navigating a sea of regulations. Lenders ensure compliance with legal requirements, from interest rate limits to documentation standards, safeguarding both parties against legal storms.

Key Players In The Field Of Loan Underwriting And Credit Risk Analysis

In the intricate process of loan underwriting, key players play pivotal roles, contributing to the thorough examination and assessment of a borrower’s financial profile.

Lenders, often financial institutions or banks, take the lead in orchestrating the underwriting process. They meticulously analyze the borrower’s credit history, debt-to-income ratio, and collateral value to gauge the feasibility and risk associated with extending a loan. Underwriters, skilled professionals within the lending institution, conduct in-depth reviews of the submitted loan applications, meticulously verifying financial documentation and ensuring compliance with regulatory standards. Their expertise is crucial in making informed decisions regarding the approval, modification, or rejection of loan applications.

Additionally, loan officers, who act as intermediaries between borrowers and underwriters, play a vital role in facilitating communication, guiding applicants through the application process, and providing insights into available loan products.

Lender's Perspective:

- Risk Tolerance: Lenders establish their risk tolerance levels based on factors such as regulatory requirements, internal policies, and market conditions.

- Creditworthiness: The borrower’s credit history, income stability, and debt-to-income ratio are pivotal in gauging their ability to repay.

Borrower's Angle:

Financial Health: Applicants must present a comprehensive picture of their financial health, including income sources, outstanding debts, and assets.

Credit Score: A numerical representation of creditworthiness, the credit score significantly influences the terms and interest rates offered.

Navigating the Rapids:

Documentation: A plethora of financial documents, including tax returns, bank statements, and employment records, are scrutinized for accuracy and completeness. Lenders may also request a detailed breakdown of the purpose of the loan, whether it’s for a home, business expansion, or education.

Appraisal and Valuation: For secured loans, collateral such as property or assets is evaluated to determine its value and mitigate potential losses for the lender. The appraisal process ensures that the loan amount aligns with the asset’s market value.

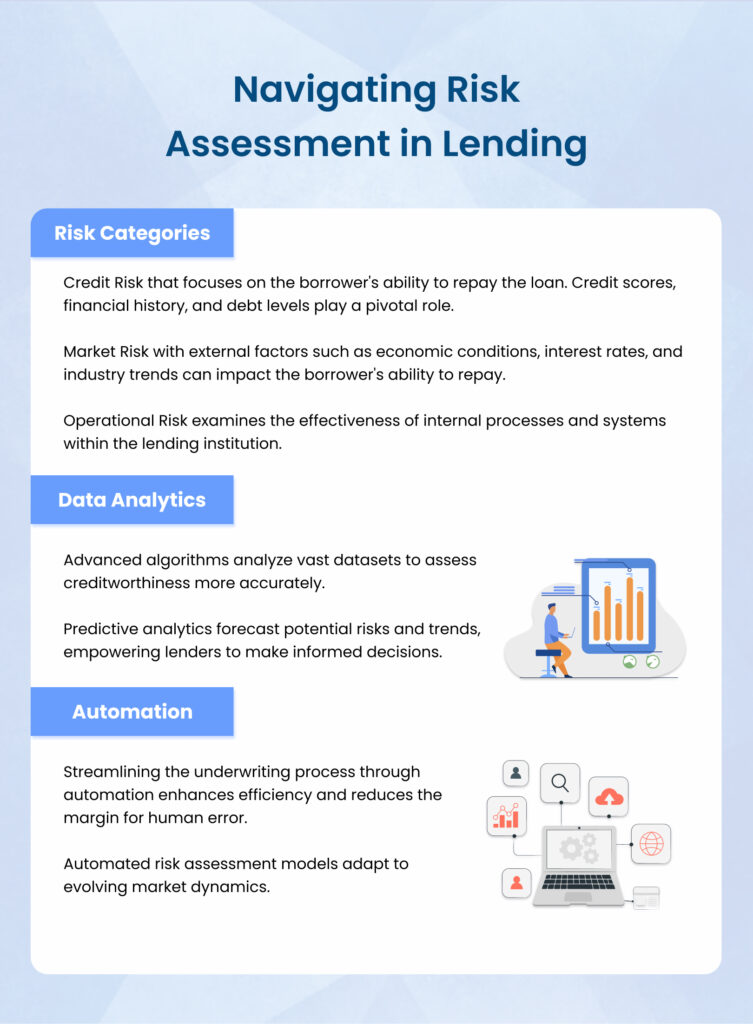

Plotting the Course: Risk Assessment in Lending

Risk assessment stands as the compass guiding the course in the vast sea of lending. Much like a ship’s captain evaluates weather conditions before setting sail, lenders navigate through a thorough risk assessment process to ensure a secure and prosperous financial journey.

Striking the Balance!

The art of loan underwriting and risk assessment lies in finding the delicate equilibrium between facilitating financial access and safeguarding against potential losses. For borrowers, it means presenting a clear and truthful representation of their financial standing. Lenders, armed with advanced technologies and comprehensive data, navigate the complex waters of risk with prudence.

Give your customers, financial support by introducing the best solutions with ! Schedule a call now.

In this symbiotic relationship, transparency, communication, and technological innovation collectively chart a course towards financial stability. Let’s build a financial journey that includes our client into a smoother, simpler and seamless flow. Talk to our experts at Think360 to know more about it in detail!