Opening an account, whether a savings account or a loan account, a new insurance or a new SIP, onboarding journeys are being crunched to minutes from days and weeks. This has brought immense power to the end user of banking services. With great speed, unfortunately, has come a higher fraud risk.

Even for an existing customer, marketing campaigns and reward plans tend to be hacked with a 1 to 300 chances of success, increasing the cost of each campaign. According to a recent study, organisations in India incur an average cost of Rs. 4000 for every Rs. 1000 lost to fraud. Think360 has worked on various aspects of the problem and has a plethora of solutions to work with.

Fraud Detection using KYC (Know your Customer)

Reserve Bank of India (RBI) has asked for higher barriers on Know Your Customer (KYC) / Re KYC to operationally bring down the risk. RBI has tightened customer due diligence regulations and asked banks and other financial institutions to adopt a risk-based approach for periodic updating of KYC information.

Our best-in-class product KwikID is designed to simplify, secure and fast-track customer onboarding journey digitally. The product helps to minimise customer drop-off while reducing client acquisition and retention costs.

Fraud Detection using Artificial Intelligence and Machine Learning Custom Models

Historical rule-based cybersecurity methods such as whitelisting and blacklisting are insufficient to adapt to constantly evolving fraud patterns today. But by leveraging Artificial Intelligence (AI) and Machine Learning (ML), organisations can identify deviating patterns in the dataset and detect anomalies in real time.

Highly customised ML models for fraud detection are fuelled by algorithms that draw insights from historical data. They can detect abnormal patterns, such as unusually high transaction amounts, strange time intervals between transactions or frequent purchases in unusual locations.

Thanks to behavioural analytics that covers thousands of factors, it is possible to momentarily discern context from numerous parameters and accurately identify fraudulent transactions.

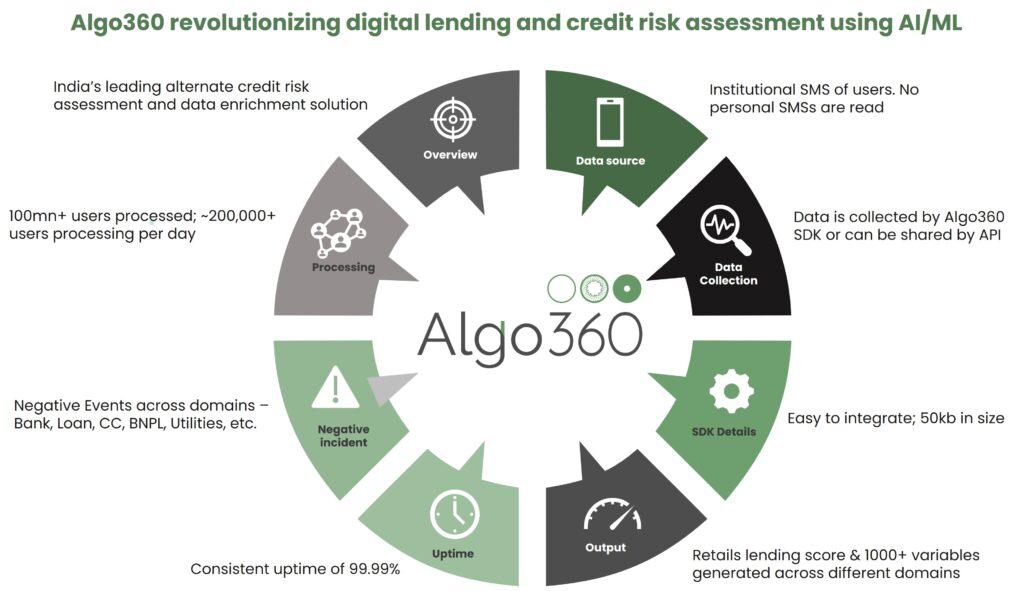

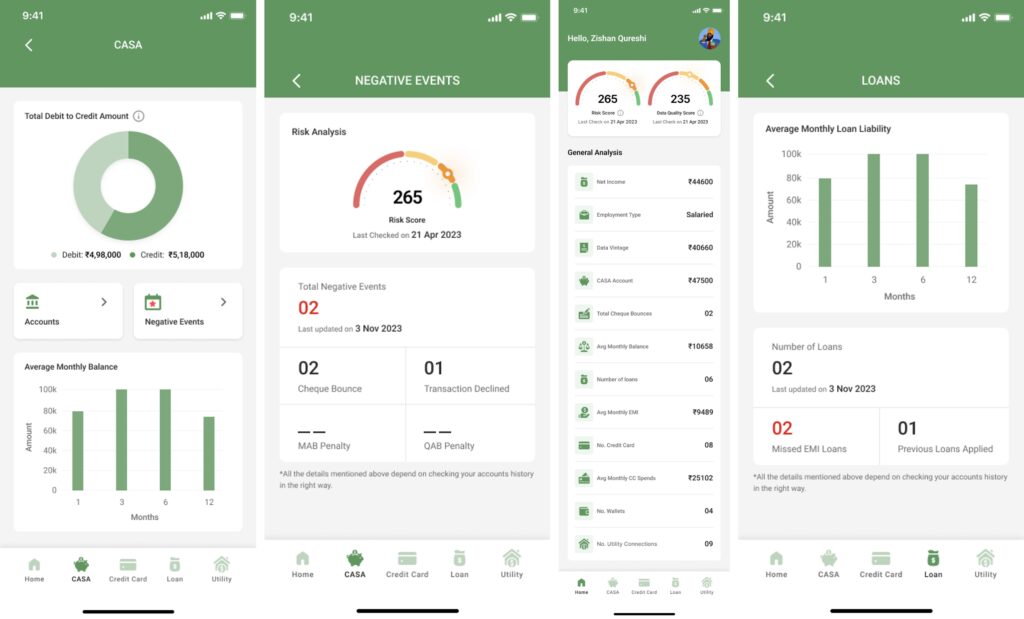

Algo360’s Capabilities in Fraud Detection

The availability of multiple factors and the ability to read those factors is what Algo360 brings in as a mobile data reading algorithm at the point of application itself. With alternate data and unified APIs, Algo360 collates multiple layers of information and provides valuable insights into your customer’s digital footprint. Its comprehensive decision-making engine and machine learning technology help you gain a more holistic view of your customers.

It continuously monitors your customer’s financial behaviour, account activity and calculates potential risk factors to prevent fraudulent transactions, while protecting your sensitive data and information. This real-time observation and analysis of customer information helps spot discrepancies, identify suspicious activities and flag potential fraud early in the cycle.

Its dedicated algorithms are designed to detect and prevent fraud for each micro-segment of customers within the financial services industry, optimized for maximum efficiency.

Algo360 has more than 40 Natural language processing (NLP) models. It efficiently reads a text by interpreting volumes of language-related data. It analyses various patterns (causal, numeric, time) and assertions within vast datasets. This helps Algo360 identify typical keywords or descriptions linked to fraudulent activity.

Transforming Challenges into Success with Algo360’s AI-Powered Solutions

Here is a glimpse at the common problems and their solutions using AI-driven algorithms within Algo360.

- Processing Time: With enormous data being processed every day, the model build must be fast enough to respond to the scam in time. Currently, Algo360 processes 99% of all customer requests within a minute.

- Imbalanced Classification: Imbalanced data pose a common challenge where most of the transactions (99.98%) are not fraudulent. This makes it difficult to detect the fraudulent data. Algo360 addresses this issue with the Synthetic Minority Oversampling Technique (SMOTE) technique. It tackles imbalanced datasets by generating synthetic samples for the minority class.

- Misclassified Data: Misclassified data can be another challenge as not every fraudulent transaction is caught and reported. This issue continues as data usually follows a time series format, with the detection timeframe often lacking clear specifications. For instance, whether fraud got detected within a day, a week or a month is not captured well by the industry.

With AI and ML capabilities, Algo360 significantly reduces misclassified data by identifying patterns and anomalies, enabling predictive analytics, improving accuracy, automating monitoring processes, and enhancing overall efficiency in processes.

At Think 360, we help lenders detect and prevent potential fraud by deploying bespoke models. Our fraud detection model allows you to focus on seamlessly onboarding customers while we proactively monitor customer activities and journeys. Every decision that allows us to move the needle even by a few bases reduces fraud losses significantly.