The Account Aggregator framework is undoubtedly one of the most breakthrough fintech innovations in recent times. Engineered to scale up financial access for a large population like India’s, it is fast gaining traction among users. As of May 2024, ~70 million accounts were linked to the account aggregator system.[i] As more individuals, FPUs, and FIUs join this revolutionary ecosystem, one thing is certain—the scope for extending, upselling, and cross-selling financial services just got a lot bigger!

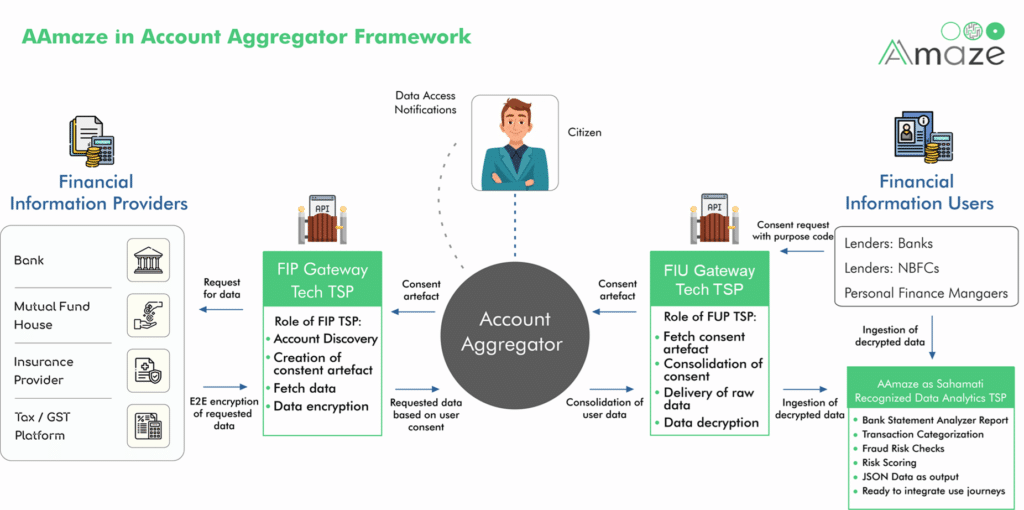

Better known as AA, an account aggregator serves as a consent manager to allow real-time sharing of a customer’s financial data to financial information users (FIUs). FIUs may be regulated entities such as NBFCs, insurance companies, mutual funds, broking firms, and so on.

The key benefit of AA is clear – with the user’s consent, an FIU can access the latter’s aggregated financial data from financial information providers (FIPs) in near real-time. AA then is simply a blind consent manager that cannot store data and offers end-to-end encryption, prioritizing data privacy and security.

But, here’s what makes AA a lot more powerful!

TSPs in the world of Account Aggregator

While AA serves as a consent custodian for the financial data, a data analytics technical service provider (TSP) can truly help make sense of this data for FIUs.

TSPs provide FIP-FIU modules around the AA framework by collaborating with FIUs and FIPs. Data analytics TSPs are capable of transforming areas such as underwriting, onboarding, lead management, product design of apps, and more.

In simpler terms, data analytics allow FIUs to make full use of the data received from AAs. Let us consider an example of how a TSP can take things up a notch when combined with AA: Suppose you are a lending institution like an NBFC. As an FIU in the AA framework, you can access a customer’s financial data with their permission to assess a loan application. What do you do with this data?

The manual underwriting process can take weeks and even months. On the other hand, using a data analytics TSP can cut down your underwriting time drastically by allowing automated analysis of bank statements and other data. Besides conventional sources such as credit bureaus, TSPs can parse through alternate data to arrive at key insights, which would otherwise be difficult to arrive at. What you get is detailed insights via automated analysis of income, spending behavior, risk levels, and more for quicker and more accurate credit decisioning.

Enter TSPs and you now have the power of AA combined with tremendous analytical potential, offering you data-driven intelligence like no other.

How AAmaze can make your decision-making quicker and better

A certified intermediary with Sahamati, AAmaze is a data analytics TSP that offers everything that a TSP does and more. Among its many use cases, AAmaze is capable of evaluating whether your customer has the capacity and willingness to repay their loan. With real-time credit analysis, data enrichment, income estimation, and risk assessment, lending becomes less risky and more efficient with AAmaze.

Moreover, AAmaze comes with several personalization features to make the end-to-end loan process more efficient. For instance, more efficient collection is enabled with nudges like rising credit card spends. AAmaze also goes beyond lending to offer valuable insurance insights.

With AAmaze, you can get ready-to-use reports for various applications. These reports can serve as ready reckoners for risk assessment, customer behavior, and many more insights.

In sum, AAmaze enables FIUs to not only streamline their processes but also elevate customer experience significantly. There are of course, tangible and intangible dividends in the form of faster turn-around times, brand loyalty, and customer retention. All this makes FIUs capable of unlocking a wider customer base along with up-selling and cross-selling opportunities.

Explore the full power of AAmaze. Contact us to know more.

About Think360.ai–

Think360.ai is a CAMS Company, and a global full-stack Data Science and AI-focused firm. In India, we are revolutionizing the lending and credit risk management landscape by leveraging the power of AI, modern SaaS applications, data science, and advanced analytics. We harness the potential of these digital technologies and financial domain knowledge to deliver state-of-the-art onboarding and underwriting solutions to banks, NBFCs, lending institutions, and insurers to further drive financial inclusion.