In an era where technology is the harbinger of change, Artificial Intelligence (AI) emerges as a force that holds the promise of transforming not just financial services but the very nature of financial inclusion. As we embark on this journey into the synergy of “Financial Inclusion Using AI,” we explore how advanced technologies are dismantling barriers, extending the reach of financial services, and paving the way for a more inclusive global economy.

In fact, A report by Accenture states that 83% of financial services executives believe that AI is either extensively or critically transforming their industry. Financial inclusion transcends traditional banking, aiming to provide equitable access to financial services for all, irrespective of geographical location or economic status. AI, with its capacity to process vast datasets, automate complex tasks, and offer personalized solutions, becomes a cornerstone in dismantling the barriers to financial services.

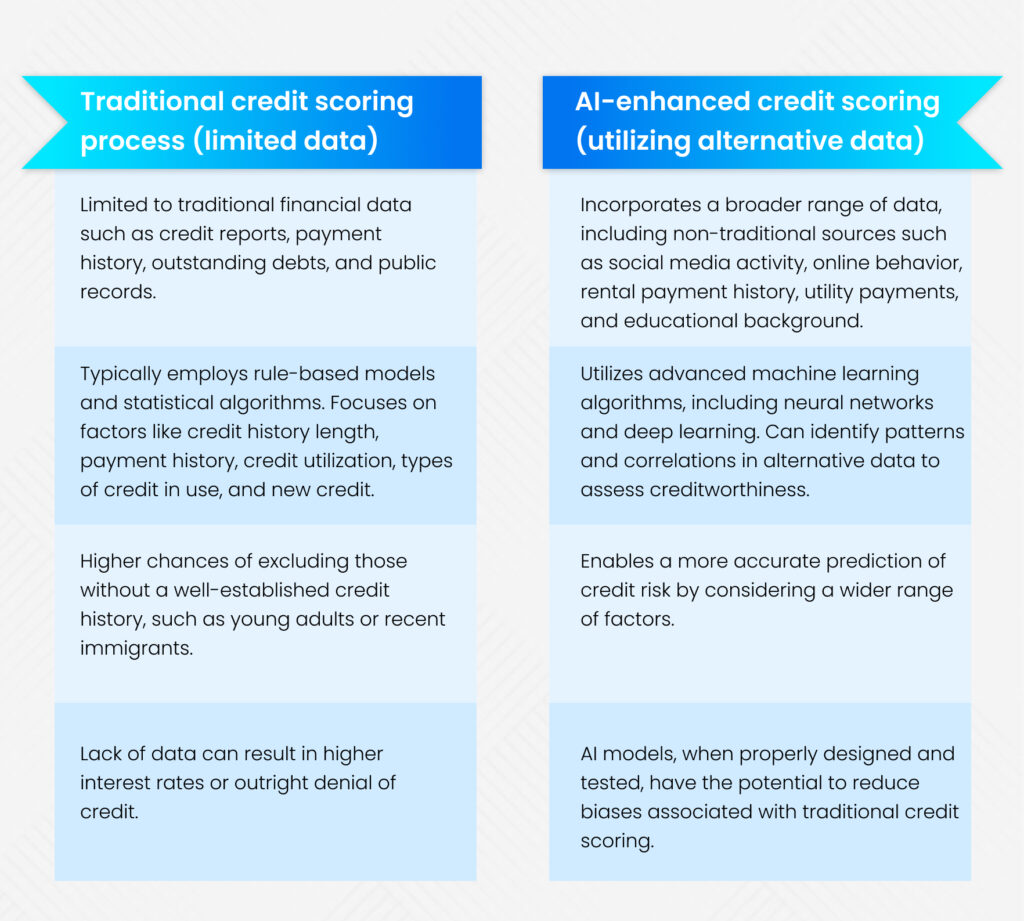

Detailed Comparison of Credit scoring with different methods to analyze risk assessment!

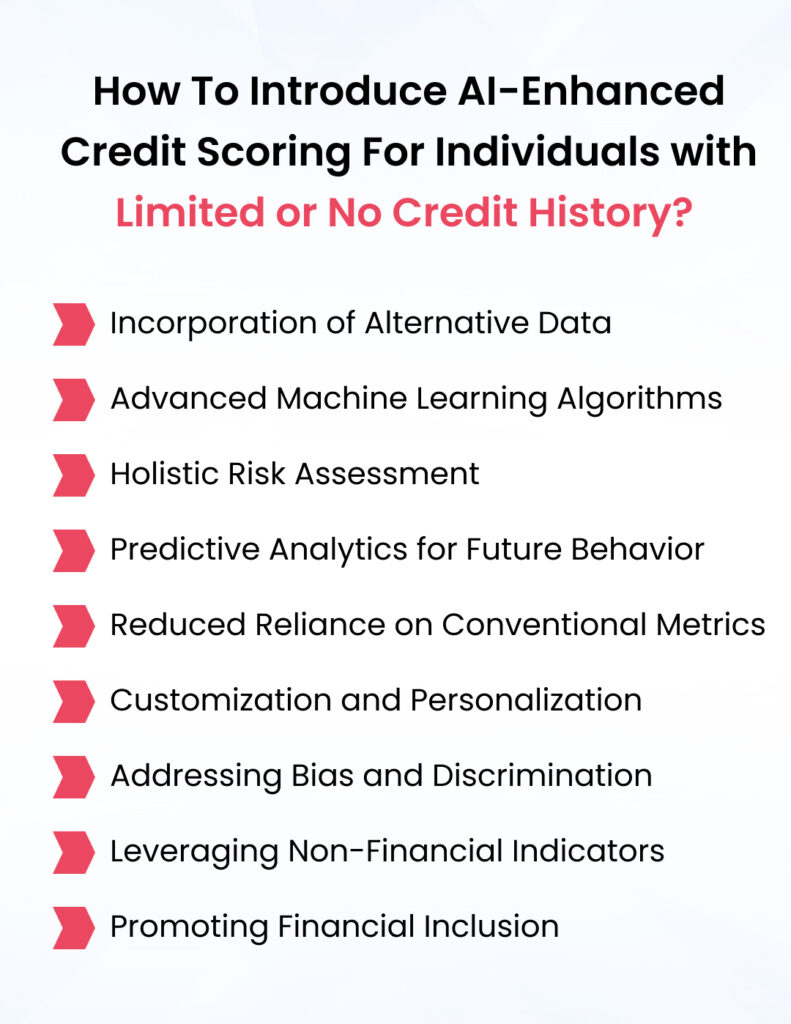

Now, that you see, how Ai has eventually brought a revolution to the field of financial inclusion, we can add in the details that can show how AI expands access to credit for individuals with no or limited credit history.

Artificial Intelligence (AI) has emerged as a transformative force, expanding access to credit by incorporating alternative data sources and employing advanced machine learning algorithms. This shift from a conventional approach to AI-enhanced credit scoring offers a more comprehensive and inclusive evaluation, considering a diverse array of factors beyond traditional metrics. In this exploration, we delve into the key aspects differentiating the traditional credit scoring process with limited data from the innovative AI-enhanced credit scoring, emphasizing how the latter fosters financial inclusion for those previously underserved by conventional methods.

Here are the details!

- AI-driven credit scoring goes beyond traditional credit reports, incorporating diverse alternative data sources. These may include social media activity, online behavior, rental payment history, utility payments, and educational background.

- Leveraging sophisticated algorithms such as neural networks and deep learning, AI models can identify intricate patterns and correlations within alternative data, providing a nuanced understanding of an individual’s financial behavior.

- Traditional credit scoring often relies on a limited set of metrics, potentially excluding individuals with no or limited credit history. AI-enhanced models offer a more comprehensive risk assessment by considering a broader range of factors, reducing the impact of sparse credit data.

- AI models utilize predictive analytics to forecast an individual’s future financial behavior. By analyzing alternative data, they can make more accurate predictions about creditworthiness, especially for those without an extensive credit history.

- Unlike traditional models heavily dependent on factors like credit history length, AI-enhanced scoring systems are designed to be more adaptive. This reduces the disadvantage faced by individuals with limited credit history, as alternative data plays a more significant role in the assessment.

- AI systems can be tailored to create personalized credit scoring models. This customization allows for a more accurate assessment, taking into account specific circumstances, behaviors, and alternative data relevant to each individual.

- Responsible development and training of AI models can contribute to reducing biases inherent in traditional credit scoring. The inclusion of a diverse range of data helps mitigate demographic biases, promoting fairer credit assessments.

- AI-enhanced credit scoring considers non-traditional indicators like job stability, education, and online behavior. This enables a more holistic evaluation, especially beneficial for individuals with limited credit history who may exhibit strong non-financial indicators of creditworthiness.

- The holistic and inclusive approach of AI-driven credit scoring facilitates increased financial inclusion. Individuals with limited or no credit history, such as young adults and recent immigrants, stand to benefit from a more equitable and accurate credit evaluation.

Some of the other key elements to keep in mind include the following!

Chatbots and Virtual Assistants:

AI-powered chatbots and virtual assistants bring financial guidance and support to the fingertips of users. Particularly significant for those without access to physical bank branches, these virtual interfaces offer a seamless way to navigate financial processes, ask questions, and gain insights into managing finances effectively.

Mobile Banking and Digital Wallets:

The marriage of AI and mobile banking applications creates a bridge to financial services for millions. Intuitive interfaces, voice commands, and personalized experiences cater to users with varying levels of digital literacy, making transactions more accessible. Digital wallets, powered by AI, streamline financial interactions, empowering users to participate in the formal financial system.

Fraud Detection and Security:

AI plays a pivotal role in fortifying the security infrastructure of financial systems. Advanced algorithms analyze transaction patterns in real-time, swiftly identifying anomalies indicative of fraudulent activities. This not only protects users but also builds trust in digital financial transactions, crucial for encouraging widespread adoption.

Benefits of Financial Inclusion Using AI:

For Borrowers:

- AI-driven financial services extend a helping hand to the unbanked and underbanked populations. By utilizing alternative data for credit assessments, AI facilitates access to loans and other financial products, empowering individuals who were once excluded from formal financial channels.

- Automation through AI reduces operational costs for financial institutions. This efficiency allows them to offer services at a lower cost, making financial products more affordable and accessible to a broader demographic.

- AI-driven virtual assistants enhance the customer experience by providing instant, personalized assistance. These interfaces are available 24/7, catering to users who may not have easy access to physical branches, thereby fostering a positive and inclusive banking experience.

Conclusion

The convergence of AI and financial inclusion is not merely a technological advancement; it’s a paradigm shift. As we witness the unfolding impact of these innovations, let us collectively envision a future where financial services are not a privilege but a fundamental right. Through the intelligence of AI, we at Think360 are not just transforming finance; we are rewriting the narrative of inclusivity, where everyone, regardless of their circumstances, has a seat!

If you need to know more about digital edge at Think360, schedule a call now!