Hidden fees, predatory practices, and confusing information have plagued the digital loan app market. But fear not, borrowers! The Reserve Bank of India (RBI) has just taken a bold step to rewrite the rules and protect your financial future. Imagine a world where borrowing is transparent, fair, and accessible to all. Imagine knowing what is digital loan is, an easy job? No more deciphering cryptic terms, fearing hidden charges, or falling victim to misleading information. This is the vision that the RBI aims to achieve with its new regulatory framework for the Web-aggregation of Loan Products (WALPs)

But how exactly will this framework impact you? Buckle up as we take a deep dive into the RBI’s plan, exploring how it will empower borrowers, promote ethical practices, and usher in a new era of responsible digital lending.

What is a Digital Loan?

Digital loans leverage technology, often through dedicated platforms or mobile apps, to streamline and expedite the lending process. Borrowers can submit applications electronically, and the approval decision is typically based on automated assessments of their creditworthiness using algorithms and data analytics. The use of digital loan app not only accelerates the loan origination process but also enhances accessibility, allowing individuals to apply for loans conveniently from their computers or mobile devices. Digital loans are a key component of the broader financial technology (fintech) landscape, contributing to increased efficiency and financial inclusion.

As of 2023, the Indian digital lending market is estimated to be worth over USD 250 billion, with a projected growth rate of 25% per annum. The digital lending landscape in India is growing, with more borrowers seeking accessible credit options. To promote responsible lending practices and protect consumers, the Reserve Bank of India (RBI) has introduced a regulatory framework for Web-aggregation of Loan Products (WALPs). This will enhance transparency, and accountability, and ensure safeguards on how digitization is helping loan disbursal.

Understanding WALPs and their Growing Role

WALPs act as online marketplaces, aggregating information on various loan products from multiple lenders and presenting them to borrowers in a comparative format. A recent survey revealed that over 67% of Indian borrowers rely on WALPs for loan comparison and selection. This simplifies the borrowing process, allowing borrowers to compare interest rates, terms, fees, and other factors across different loan options.

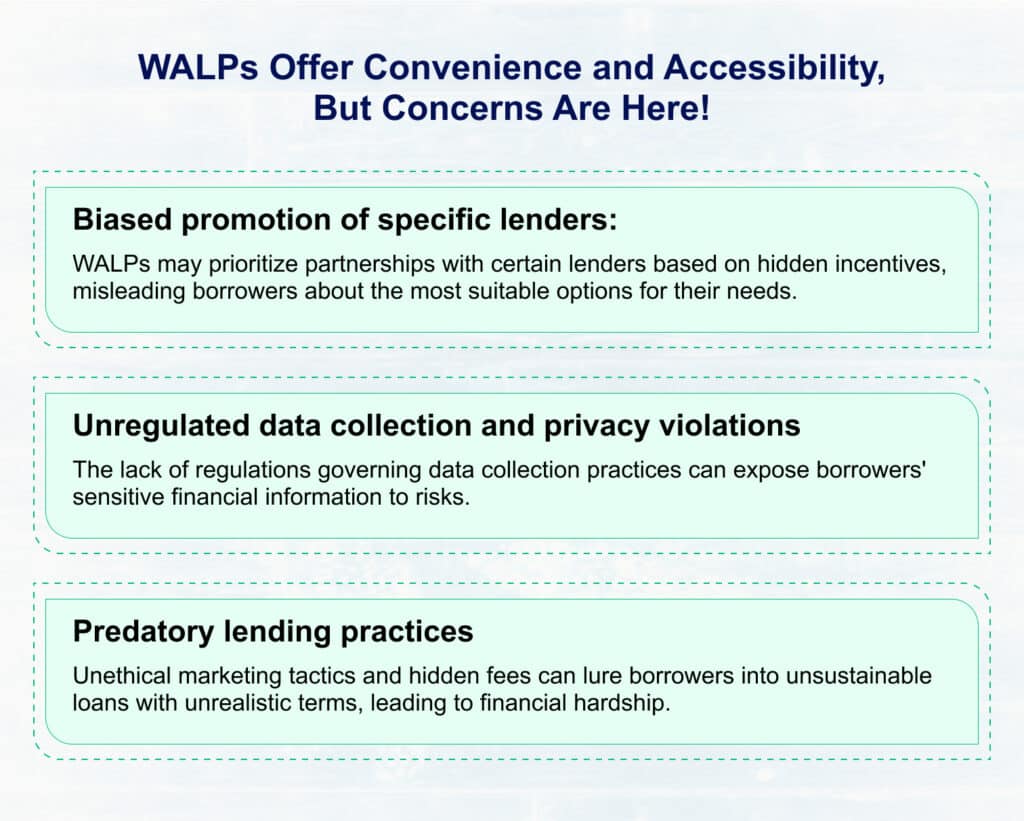

While WALPs offer convenience and transparency and also address how digitization is helping loan disbursal, concerns about potential risks and lack of accountability have risen due to their unregulated nature. These concerns include:

RBI's Framework: Tackling Challenges and Fostering a Responsible Ecosystem

- Stringent Licensing Requirements: Only entities meeting rigorous registration and compliance criteria can operate as WALPs. This ensures a baseline of professionalism, and ethical conduct, and mitigates risks associated with unregulated players.

- Enhanced Data Privacy and Security: Strict regulations govern data collection, storage, and sharing by WALPs, prioritizing the protection of borrowers’ financial information. Standardized data security protocols further safeguard sensitive data.

- Mandatory Transparency and Disclosure: WALPs must disclose their ownership structures, fees, partnerships with lenders, and any potential conflicts of interest. This transparency allows borrowers to make informed decisions based on complete information.

- Proactive Measures to Promote Fair Practices: The framework prohibits unfair marketing practices and misleading information. It mandates accurate and comprehensive information about loan products, empowering borrowers to make informed choices.

- Regulatory Oversight and Enforcement: The RBI will actively monitor and enforce compliance with the framework, ensuring that WALPs operate within the stipulated regulations. This promotes a level playing field and protects consumer interests.

Benefits of a Regulated Digital Lending Ecosystem

The RBI’s regulatory framework is expected to yield significant benefits for digital loan app while keeping in mind both borrowers and lenders:

For Borrowers:

- Safer and More Transparent Lending Environment: Borrowers can confidently engage with licensed WALPs, accessing accurate information for informed loan choices.

- Wider Range of Loan Options and Lower Rates: Competition among WALPs increases, encouraging them to offer a wider range of products and potentially negotiate lower interest rates for borrowers.

- Enhanced Financial Literacy and Consumer Protection: The framework promotes financial literacy among borrowers through standardized information formats and improved grievance redressal mechanisms.

For Lenders:

- Reduced Risk and Improved Reputation: Responsible lending practices mitigate risks associated with predatory lending, safeguarding lenders’ reputations and minimizing credit defaults.

- Increased Access to Potential Borrowers: WALPs offer lenders access to a wider audience of borrowers, expanding their customer base and market share..

- Enhanced Operational Efficiency and Regulatory Compliance: Standardized processes and regulatory oversight reduce operational costs and ensure compliance with all relevant regulations with digital loan app.

Conclusion

The RBI’s proactive approach in introducing what is digital loan, a regulatory framework for WALPs is a crucial step towards fostering a responsible, transparent, and accountable digital loan app in India. By prioritizing transparency, protecting data privacy, promoting fair practices, and ensuring regulatory oversight, this framework empowers borrowers, safeguards their interests, and lays the foundation for a stable and inclusive digital lending landscape.

Schedule a call with us and enhance your credit lending landscape now!