Over the last decade, lending in India has gone from slow, paper-heavy approvals to app-based journeys that wrap up in under a minute. If the early years were about “going digital,” 2025 was the year when maturity, compliance, and trust became central to how credit was delivered.

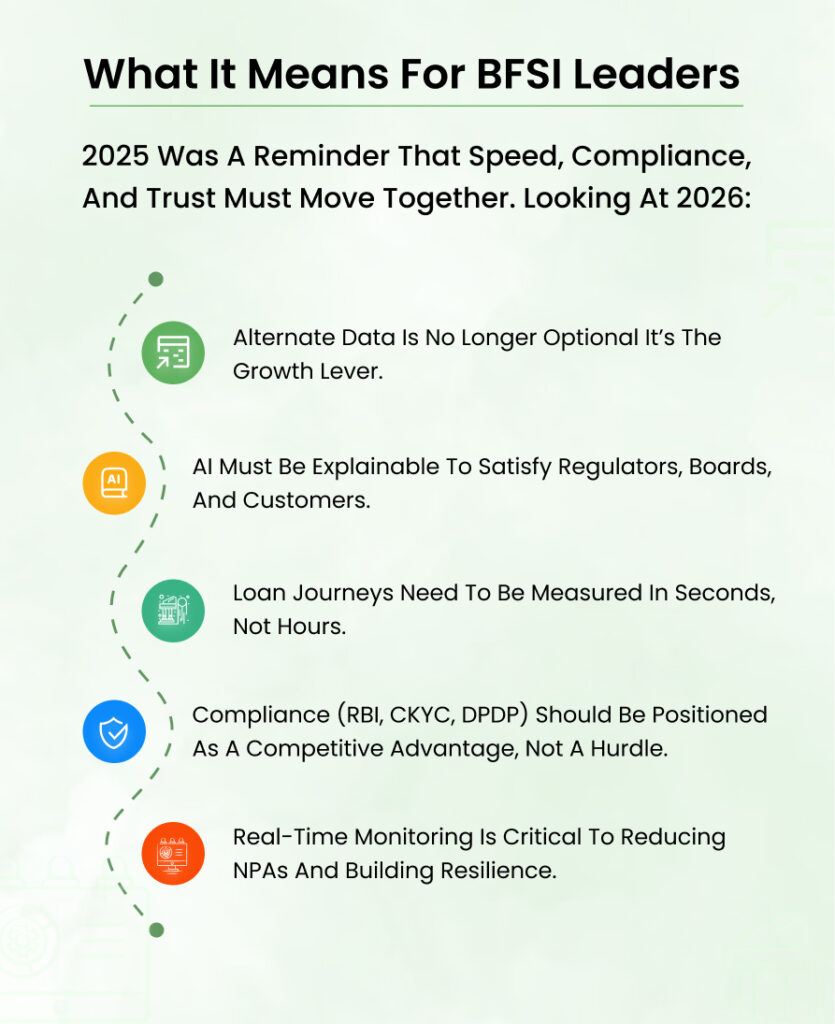

As we head into 2026, lenders face both opportunities and challenges: how to grow faster, stay compliant, and keep customer trust in a landscape that’s changing almost monthly.

What 2025 Showed Us

“2025 was the year when speed alone wasn’t enough. Accuracy, compliance, and trust took center stage.”

“2025 was the year when speed alone wasn’t enough. Accuracy, compliance, and trust took center stage.”

Alternate data is here to stay

Credit bureau scores are still relevant, but 2025 proved they can’t capture the full story. Lenders began leaning on UPI trails, SMS alerts, utility bills, and digital payments to underwrite gig workers, thin-file borrowers, and first-time credit seekers.

The outcome? Approval rates rose without a corresponding spike in NPAs, making alternate data less of an experiment and more of a core underwriting layer.

AI had to explain itself

This year, regulators and boards demanded clarity. Lending models that couldn’t justify why a borrower was approved or declined didn’t hold up.

“Explainable AI moved from a buzzword to a business necessity.”

Platforms offering audit-ready, transparent underwriting became the default choice for BFSI leaders who wanted both accuracy and regulator comfort.

Loan journeys got shorter

Patience levels kept shrinking. Borrowers expected approvals to be completed in under 60 seconds, often within the apps or platforms they already use. Anything longer felt outdated.

For lenders, this wasn’t just about speed. It was about building frictionless, embedded credit experiences that matched customer expectations.

Compliance turned into a trust signal

The RBI’s Digital Lending Guidelines, CKYC 2.0 mandates, and the DPDP Act, 2023 raised the compliance bar. Instead of treating them as a burden, smart lenders used compliance to differentiate themselves winning trust with both regulators and customers.

Risk monitoring got sharper

By the end of 2025, real-time risk monitoring was no longer optional. Leading lenders were running continuous portfolio analytics, catching stress signals from UPI and SMS data weeks before defaults showed up in bureau records.

This shift helped cut potential NPAs by as much as 25%

What’s Coming in 2026

Credit everywhere, but under oversight

Expect lending to embed deeper into ecosystems healthcare apps, e-commerce, mobility platforms. But this growth will be shaped by regulatory guardrails. The RBI’s proposed FREE-AI framework already highlights the need for fair, responsible, and explainable AI in financial services (Reuters, Aug 2025).

Personalized terms, with transparency

Dynamic loan limits and pricing are on the horizon. But with DPDP Act provisions requiring consent to be “specific and informed,” personalization won’t just be about AI sophistication it will need clear explanations to both customers and regulators.

Consent as a new competitive edge

With the DPDP Act in force, how you manage consent, logging it, refreshing it, and allowing withdrawal will become a trust marker. BFSI leaders that can prove transparent consent management will stand apart in customer acquisition.

Inclusion at scale

The next big growth driver will be rural and semi-urban India, powered by alternate data underwriting. The challenge? Scaling responsibly while respecting DPDP’s data minimization and purpose-limitation principles.

“2026 won’t be about who digitizes first it will be about who scales responsibly and earns trust.”

At Think360, our Algo360 platform is built for this future. In 2025, we helped BFSI leaders:

✅ Cut defaults by up to 25%

✅ Deploy risk models 70% faster

✅ Approve more thin-file borrowers

As 2026 approaches, the opportunities are bigger but so are the expectations.

Let’s start the conversation. Book a demo and explore how your lending workflows compare with industry leaders.