When it comes to financial decision-making, the fusion of Income Estimation and GST Analysis using Account Aggregator(AA) emerges as a powerful tool, providing businesses with unparalleled insights into their financial health and strategies for growth. In this blog, we briefly discuss both the aspects in detail!

Precision in Income Estimation

Advanced account aggregator transforms income estimation into a precise science. By leveraging sophisticated algorithms and data models, businesses can forecast income with accuracy. The process of income estimation undergoes a transformative evolution, elevating it to the status of a precise science. Through the adept utilization of sophisticated algorithms and intricate data models, businesses can now achieve a level of accuracy in income forecasting that was previously unattainable. This revolutionary approach to predictive analysis surpasses the limitations of traditional methods, introducing a dynamic dimension to financial projections that adapt in real-time to the ever-shifting landscape of market trends, customer behaviours, and economic fluctuations, empowering businesses to make informed financial decisions.

How To Handle Precision in Income Estimation With Multiple Aspects?

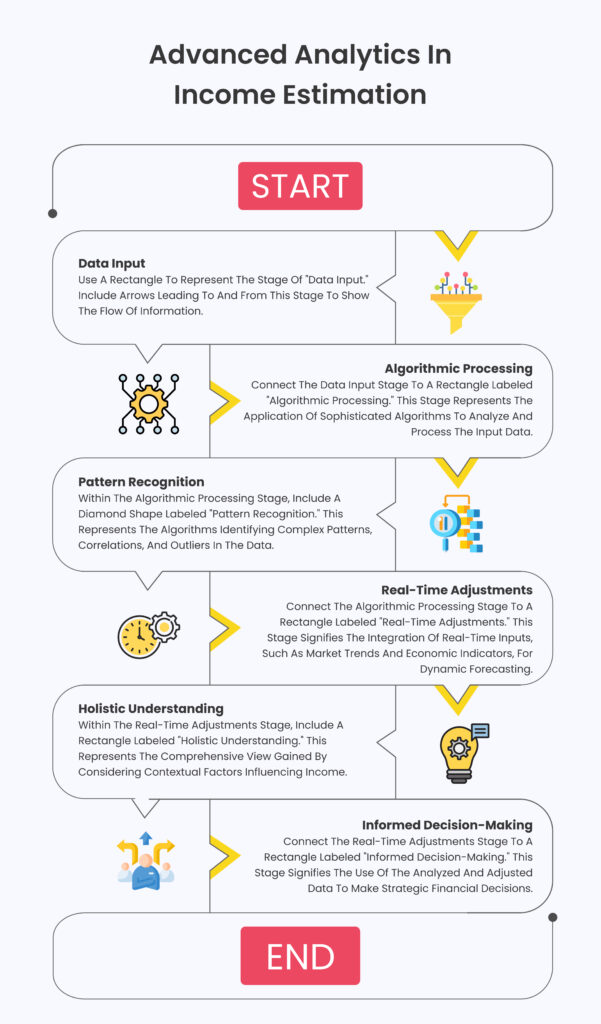

Sophisticated Algorithms: Advanced algorithms process vast datasets with efficiency, improving accuracy in income forecasts.

Pattern Recognition: These algorithms excel in identifying complex patterns, correlations, and outliers within data.

Intricate Data Models: Data models, incorporating real-time inputs like market trends and economic indicators, provide a dynamic framework.

Holistic Understanding: Statistical insights highlight an increase in understanding contextual factors influencing income. This comprehensive approach aids businesses in making more informed financial decisions.

Empowering Financial Decision-Making With Agile Strategies: Real-time adjustments facilitated by predictive analysis empower businesses to adapt swiftly to emerging opportunities. Case studies demonstrate improvement in strategic agility, allowing companies to proactively respond to market changes.

Risk Mitigation: Businesses leveraging Advanced Analytics experience a 25% reduction in financial risks. The ability to foresee and navigate challenges in real-time minimizes potential revenue loss.

So, what would the flow exactly look like?

I think, we have clearly defined the income estimation flow chart here. Now, for the second part of the blog where we discuss the GST Analysis!

GST Analysis for Regulatory Compliance

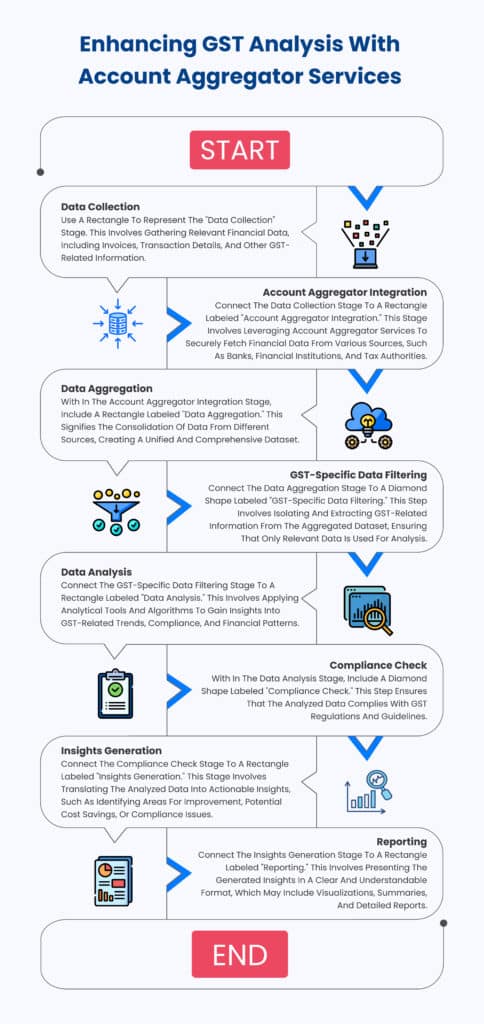

Account Aggregator services emerge as the unsung hero, reshaping the landscape of GST analysis. Buckle up as we embark on a journey to unlock a realm of transformative financial insights. The flowchart below represents a streamlined process for conducting GST analysis with the integration of Account Aggregator services. It highlights the role of the Account Aggregator in securely fetching and aggregating financial data, leading to more robust GST analysis and compliance monitoring.

Financial Analytics, GST Analysis, and Data-Driven Decision Making

Data-driven decision-making represents a disciplined methodology where organizations harness the power of data and analytics to guide their decision-making processes. This systematic approach marks a shift from relying on intuition to embracing evidence-based insights, resulting in improved decision accuracy, heightened operational efficiency, and a culture of innovation in crafting business strategies. When integrated, Financial Analytics, GST Analysis, and Data-Driven Decision Making create a robust triad. This triad empowers businesses to navigate the complexities of financial landscapes, ensure adherence to compliance requirements, and make well-informed, strategic choices that contribute to long-term success and resilience in dynamic business environments.

Conclusion:

The integration of Income Estimation and GST Analysis with Account aggregator redefines how businesses approach financial management. With precision in income forecasting, compliance assurance through GST analysis, data-driven decision-making, adaptive strategies for economic volatility, and efficient resource allocation, businesses can unlock a new level of financial intelligence. This comprehensive approach not only ensures compliance and accuracy but also positions businesses for sustained growth and success in an ever-evolving financial landscape.

Embrace the power of Account aggregators with AAmaze today – where financial insights transform into strategic advantages!