Given the changes in market due to coronavirus pandemic, pharmaceutical companies are advised to refine their commercial models—keeping in mind the needs of patients and healthcare professionals

The coronavirus pandemic has given a new definition to normal by creating an extraordinary stress on society, mainly due to the aspects of the fear of the infection and the infection itself, leading to reduced physical gatherings of any nature. Staying at home and working from home have become the new norm while going out and traveling have taken a backseat. While this has affected market dynamics across industries, e.g., retail, financial services or transportation, the shift in the healthcare industry has been unprecedented. A visit to the doctor’s office is compared to a war-like scenario, with paranoia and fear clouding our previously mundane schedule.

The questions that most often arise are about the seriousness of the health problem, especially if the symptoms are different from COVID-19. While the volatility of the pandemic has put a lot of things in perspective for governments across the world, at the forefront of all this are the healthcare professionals (HCPss). Almost all industries have moved to a contactless model of business and HCPs are not far behind either with telemedicine.

Given the interconnected healthcare system in the United States (US), the onus is on pharmaceutical companies, payers and other stakeholders to redesign their commercial models by accommodating the changing needs of patients and HCPs.

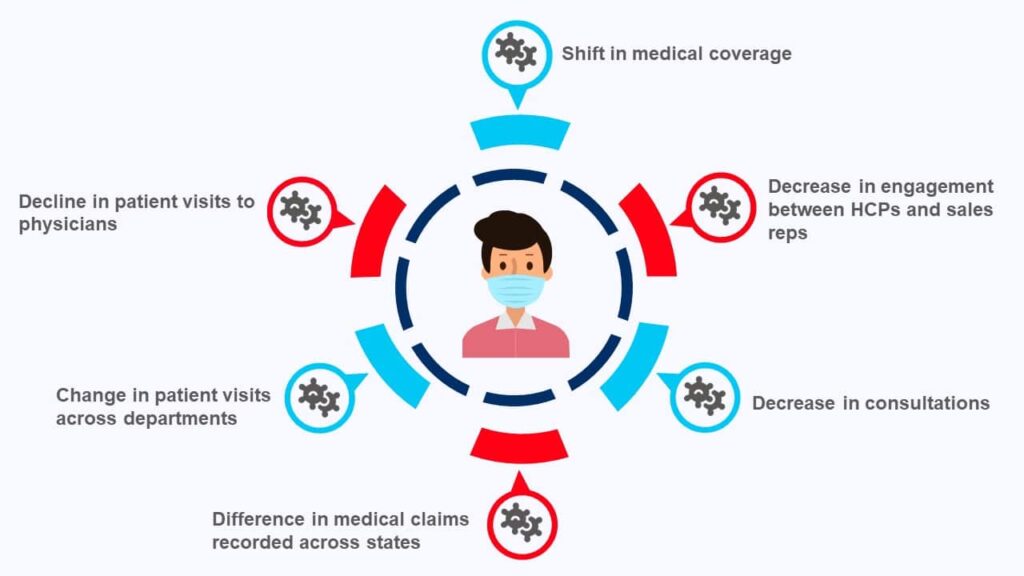

Immediate impact of coronavirus

The spread of the Covid-19 pandemic adversely impacted healthcare providers and systems [1]

- Decline in patient visits to physicians: 80 percent physicians reported a drop in patient volumes, while 62 percent saw a significant drop. This fall is somewhat larger in new patients than existing patients

- Change in patient visits across departments: Oncology weekly patient visits dropped gradually, compared to dermatology and cardiology, owing to the sense of urgency for healthcare among patients and physicians

- Difference in medical claims recorded across states: Places with early onset of infection and lockdown orders (e.g., Los Angeles) witnessed quicker decline in medical claim volumes, as compared to other big cities that have seen huge declines in medical claims in later months

- Decrease in consultations: Around 45 percent physicians reported loss in patient volume despite remote-consultation facilities

- Decrease in engagement between HCPs and sales reps: Companies have removed personnel from the field due to risk of infection. Digital channels unable to make up for this loss due to the immediate attention of physicians for COVID-related consultations and the overarching dominance of in-person engagements.

- Shift in medical coverage: Due to rising unemployment situations, many people moved from employee-driven commercial coverage to a government-backed one.

Way forward for pharmaceutical companies

On revaluating the newly adopted commercial mix – there are broadly two questions that come to mind from an HCP engagement perspective – Which and When?

Using an omnichannel customer centric engagement plan, majority of the brand managers of these companies have taken a keen interest into how to create two-way channel to better target the physicians and patients based on their geographies, specialty and site of care. Companies can think of changes that span the entire organization by –

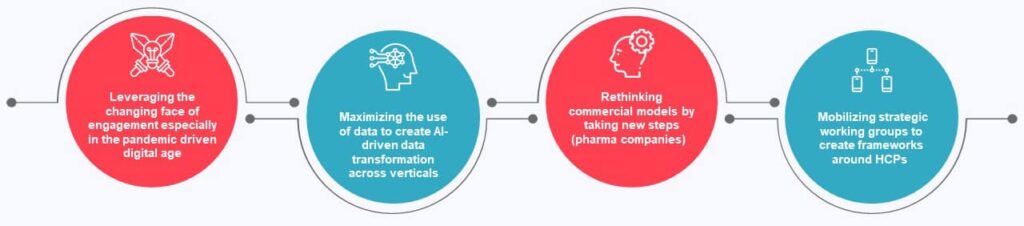

Companies can think of changes that span the entire organization:

- Leveraging the changing face of engagement especially in the pandemic driven digital age, with enhanced data and technology for upskilling current frontline representatives. Areas of focus would be technical troubleshooting skills, virtual engagement seminars and digital conversation builders.

- Maximizing the use of data to create AI-driven data transformation across verticals: With the amount of data being captured, there are a multitude of pre-and-posttracking and analyses that can be done giving way for an AI-driven data transformation across most verticals.

- Rethinking commercial models by taking new steps (pharma companies) to meet the new needs and expectations of customers and to do so in timely and collaborative ways. These companies will be best positioned to adapt successfully through the crisis recovery and the next normal that follows.

- Mobilizing strategic working groups to create frameworks around HCPs and thereby generating real-time recommendations for whom and when to target will greatly benefit brand managers to re-enter the market. They could use customized call planning strategies, considering the needs of the physician and the patients.