Background

The biotechnology and pharmaceutical industries are facing significant challenges with their existing business models due to expiring drug patents, also known as patent cliff.

Patents on drugs are typically for twenty years from the patent approval until expiration, although other factors can alter this standard timeframe. Patent cliff refers to a sharp decline in revenue or profitability when a firm’s patents expire, opening them up to competition, when generic drug makers may begin grabbing market share. It has been estimated that large manufacturers will only be able to replace each dollar of expiring-patent revenue with 26 cents of new product revenue, thus declining the risk tolerance of venture capitalists and other investors and increasing complexity in translational medicine.[1] The combination of loss of revenues due to loss of patent protection and generic competition along with increased economic risks and capital outflows, have created an urgency for innovative financing approaches that can support more productive drug development. To bridge this gap, a new approach to commercializing biopharma research based on financial engineering techniques such as portfolio theory, securitization and drug royalty investment have come into picture. The challenge for these new investment companies is identifying the right drug/research to finance due to the lengthy, expensive, and risky nature of the drug discovery process in the biopharma industry.

Lifecycle of a drug development process

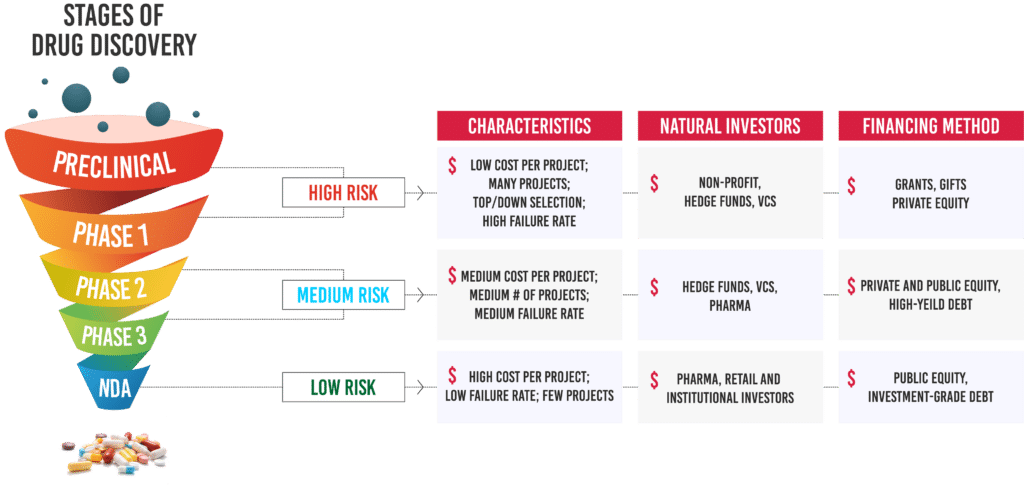

Before entering the market, a drug must pass through many levels of research followed by clinical trials, incurring varying costs at each stage. The new drug development process starts in the so-called “preclinical” phase, which includes the search for certain chemical compounds with potential medicinal value and then testing the properties (such as chemical stability, toxicity, efficacy, and side-effects) of candidate compounds on laboratory animals such as mice. Once a compound demonstrates sufficient promise in the preclinical phase, the next step is to begin testing it with human subjects. This is done in three successive phases –

- In Phase I, general qualities such as safe dosages and metabolic effects are evaluated in a small number of volunteers.

- Subsequently in Phase II trials, preliminary efficacy and safety data is obtained from patients with the target disease or condition.

- Phase III involves large-scale trials and is the final clinical phase before approval. Upon successful completion of Phase III trials, the drug developer can submit a new drug application (NDA) to the FDA for review and marketing approval.

Why is investing in the biopharma industry risky?

Typically, most drug discovery and preclinical data collection occurs outside pharmaceutical companies, in academic institutions. Phase I and Phase II human trials are then typically conducted at small and mid-cap biotech companies, after which the drug is passed on to the main marketers—large-cap pharmaceutical and biotech companies.

Each of the three stages in the development cycle has different infrastructure and expertise requirements and requires significant financial investments. This lengthy, expensive, and risky nature of the drug discovery process in the biopharma industry makes it risky for investors to finance drug discovery.

Why are investors betting big on biopharma?

The number of scientific breakthroughs in translational medical research has been growing, thanks to a confluence of innovations in basic science and bioengineering, supported by computational advances such as high-throughput screening of chemical compounds, silica drug discovery, faster and cheaper gene-sequencing techniques etc.

Therefore, new investment opportunities have never seemed more fruitful, particularly in the early stages of the drug development process. However, as investors move into earlier-stage assets, the economic risk becomes greater since very little is known about the assets’ efficacy, toxicity, and side effects.

How does their Business Model focus on risk mitigation?

Alternative investment companies that have emerged to bridge the biopharma funding gap are mitigating this risk by purchasing economic interests in drug royalty streams. Such purchases allow universities and biopharma companies to monetize their intellectual property, creating greater financial flexibility for them, while giving investors an opportunity to participate in the life sciences industry at lower risk.

Most profitable but highly risky investments are early-stage investments.

Our Approach (Due diligence):

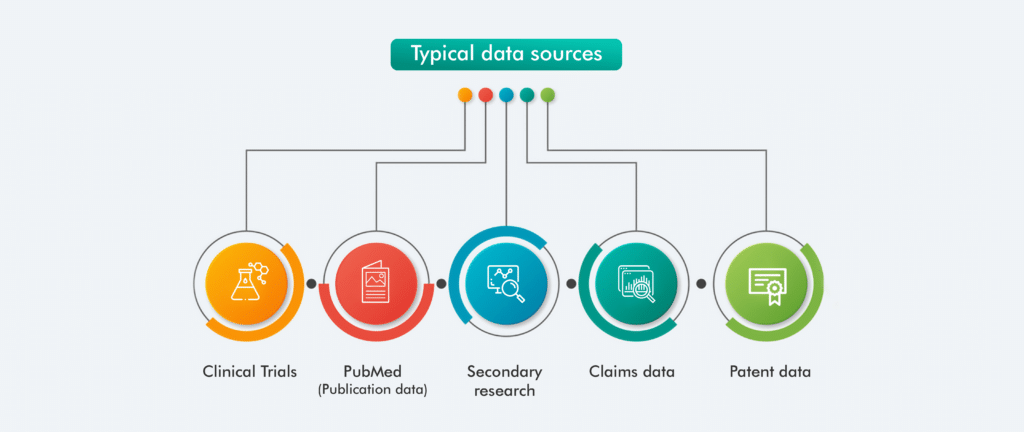

Most companies/investors investing in early-stage drugs have scientifically trained teams that can map out competitive landscapes to put data into context, identify breakthroughs, and conduct technical diligence. This entire process is tedious, time taking and labour intensive.

Think360 provides a framework for quick product evaluation at an early stage. This framework helps investors’ internal teams to filter out non promising products and spend their time, energy and resources wisely in focused ways.

Our framework evaluates any product/molecule/research in four stages to establish its merit, provide accurate sales estimates, and thus understand potential revenue streams. The evaluation is conducted based on the following broad categories:

- By scientific merit:

Benefits of our approach:

- Easily separate wheat from chaff – Our dynamic network mapping technology and use of best-in-class algorithms help identify the industry thought leaders, credible researchers, institutions, and research papers within any therapeutic area easily. This process shortens the long, tedious, and time-consuming process of identifying credible research to just a couple of weeks.

- Our framework ranks the research papers/institutions based on their meta data on three major criteria– relevance, reach and resonance. This score is used for users to further drill down on relevant research institutions/groups.

- Novelty of the research – Novelty score is provided for all research processes. This score helps in segregating new work from already existing work.